What is Environmental, Social and Governance (ESG)?

What does ESG mean?

- Environmental

- Social

- Governance.

What is ESG?

ESG is a framework outlining an organisations sustainable and responsible business practices and commitments to long-term sustainability in a changing world. ESG focuses both on qualitative and quantitative factors which are not typically captured or reported by organisations. ESG reporting demonstrates to stakeholders that the organisation has a focus on sustainability.

There is an increasing focus across all industries on ESG risk management and sustainability as the framework becomes more important to stakeholders of all kinds. ESG should be regarded as an opportunity, not a risk.

Benefits of ESG

Sustainability and transparency are increasingly associated with successful financial performance and value creation and have long-term investor appeal.

Organisations addressing ESG factors may find benefit from increased returns and attract greater interest, investment and support from private investors, shareholders, government and donors.

Specific activities include:

- improved environmental performance

- improved employee health and wellbeing

- increased stakeholder engagement

- access to alternative funding

- improved transparency of supply chain risks

- attracting the ‘ethical consumer’.

Where to start with ESG?

Although a relatively new concept ESG can be enhanced, implemented and reported for most organisations.

Organisations are most likely already doing many activities in regards to ESG, to assist in developing an ESG sustainability strategy and report an organisation should:

. Review and assess current initiatives and policies already present in the business, and what data is currently captured.

. Engage its stakeholders and determine what ESG factors are important to them and the organisation.

. Complete an ESG maturity analysis to determine gaps against desired goals and current state, agreeing on initiatives to reach set objectives and develop ways to measure performance against goals either via data or other means.

. Develop an ESG sustainability report which can be used to monitor performance and drive improvement through implementation of strategies.

“Think globally, act locally” has a tangible meaning for organisations looking at ESG reporting and developing a sustainability strategy.

The three pillars: Environmental, Social and Governance are listed below, with examples of issues that may fall under each pillar.

Environmental

- Managing carbon and climate change

- Energy consumption and efficiency

- Emissions reduction

- Water management and recycling

- Waste and pollution management and recycling

- Transition to a circular economy

- Renewable energy and clean technology

- Protection of Indigenous land

- Biodiversity.

Social

- Human capital development

- Health and safety

- Ethical supply chain and sourcing

- Human rights

- Diversity equality and inclusion

- Customer experience

- Indigenous rights

- Employee safety and wellbeing

- Sustainable supply chain

- Employee engagement

- Privacy and data security

- Community engagement.

Governance

- ESG reporting

- Risk-mitigation and management

- Board diversity and independence

- Legal and regulatory compliance

- Executive pay

- Tax transparency

- Business ethics

- Governance and accountability

- Stakeholder engagement

- Policies that enhance corporate behaviour.

View our ‘Environmental, social and governance – ESG pillars explained‘ article to learn about these ESG factors.

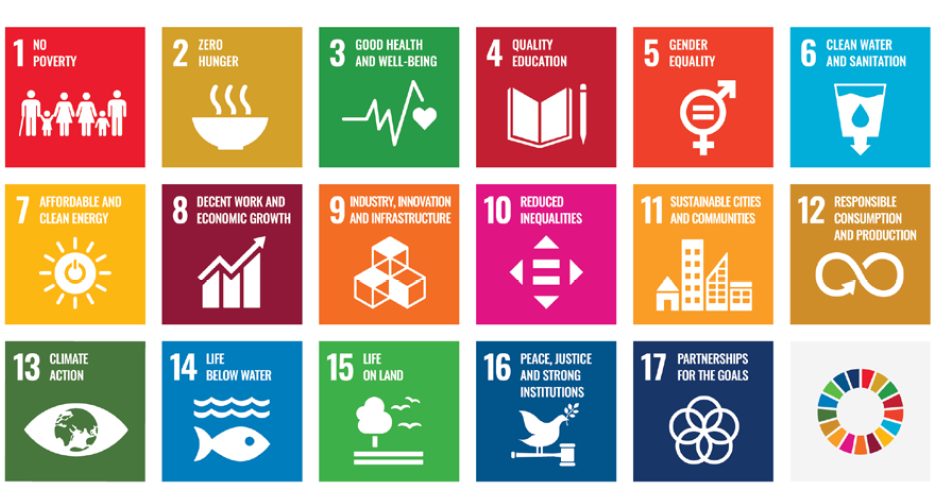

Sustainable Development Goals

The 2030 Sustainable Development Goals adopted by the United Nations in 2015 is a great starting point for organisations to explore how they could become sustainable.

Stakeholders and ESG

The demand for ESG reporting by various stakeholders is continuing to grow. An organisation’s stakeholders include its owners/investors (shareholders), employees, customers, suppliers, the government and its community.

An organisation should ask its stakeholders what ESG factors are important to them. This allows the organisation to prioritise ESG strategy and sustainability reporting on the areas that matter most to stakeholders.

Reporting and Disclosures

Stakeholders are looking for better ESG disclosures to help them understand more about how a company performs, makes decisions, creates value and remains sustainable into the future. There is currently no universal categorisation on how to report an organisation’s ESG performance.

Once the organisation has determined ESG elements to measure, monitor and report on, sustainability reporting can be established to monitor progress toward desired ESG outcomes.

The International Sustainability Standards Board (ISSB) was established at COP26 to develop a comprehensive global baseline of sustainability disclosures for capital markets. In March 2022, the ISSB released two exposure draft reports:

- General sustainability-related disclosure requirements

- Specifies climate-related disclosure requirements.

The ISSB are seeking to issue final standards by the end of 2022 to provide a global, consistent and comparable sustainability reporting framework. Creating clear and transparent ESG reporting for all organisations to adopt to show they are serious about ESG sustainability and performance.

There are a number of internationally recognised ESG (sustainability) reporting frameworks currently in place, which organisations can adopt now if they wish to be seen as an ESG sustainability leader.

Conclusion

Whilst ESG sustainability is in its infancy, now is the perfect time to incorporate ESG into your risk management processes. Include ESG on your organisations risk register and begin planning how it might fit into your long-term strategic plan. With rapidly increasing focus on climate change and ESG from all stakeholders, there could be opportunities missed if no action is taken quickly.

If you would like guidance on how ESG fits into your organisation, please call us on 03 5443 0344 or email afs@afsbendigo.com.au.