Tax Alert December 2017

Employers on notice over SG payments

Employers who fail to pay their employees’ super on time are likely to find themselves on the receiving end of some unwelcome attention after the tax office was given more resources. Here’s a roundup of the latest tax news:

Super payments under the microscope

New funding for the Australian Tax Office (ATO) will give it more resources to tackle non compliance with the requirement for regular employee superannuation guarantee (SG) payments by some employers. In addition, legislation will be introduced to close the legal loophole allowing employers to deduct salary sacrifice contributions made by their employees from their SG payments.

According to the Government, the new money is designed to give the tax office “near real time visibility” over employer SG compliance, with super funds required to report at least monthly all contributions received on behalf of employees.

Single Touch Payroll for super information will be rolled out to employers with 20 or more employees from 1 July 2018, with smaller employers moving to the system from 1 July 2019.

SMEs could be excluded from tax cuts

Legislation for proposed cuts to the company tax rate over the next few years could see some small and medium corporations miss out due a new, more clearly defined test for eligibility. This will replace the original requirement for a company to be simply ‘carrying on a business’.

Under the new legislation, eligible corporations will be required to have no more than 80% ‘passive’ income, leaving entities with over 80% of their assessable income from sources such as interest, dividends and royalties locked out of the lower tax rates.

The ATO’s definition of passive income includes dividends other than non-portfolio dividends; franking credits on those dividends; non-share dividends; interest income, royalties and rent; and net capital gains.

Notification of SMSF changes

The ATO has issued a reminder to SMSF trustees that they must notify it in writing within 28 days of any major changes to the fund.

Trustees must notify alterations to the fund’s name, address, contact person, membership, fund trustees and directors of the fund’s corporate trustee. Reporting of any changes to the SMSF’s bank account details and electronic service address is also required.

Tax penalty rates announced

The new quarterly rates applying to tax shortfalls and penalties during the 2017/18 tax year have been announced by the ATO.

The rate for the general interest charge (GIC) during the October-December 2017 quarter is 8.7%, while the shortfall interest charge (SIC) is 4.7%. GIC penalties for late payment and other tax obligations are imposed on tax debts relating to income tax, FBT, GST and PAYG.

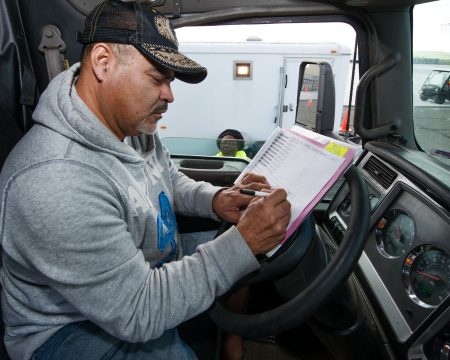

Meal deductions back for truckies

Truck drivers claiming for their meals away from home have received a reprieve from the ATO following a decision to reinstate deductions on a meal-by-meal basis.

New reasonable meal amounts are listed in a revised Taxation Determination, with employee truck drivers able to claim $24.25 for breakfast, $27.65 for lunch and $47.70 for dinner in 2017/18. These amounts cannot be combined into a single daily amount or moved from one meal to another. Drivers who have been using, or wish to continue using, the published daily amount of $55.30 can continue to do so.

Under the meal deduction rules, there are no limits on the amount a driver can claim when travelling away from home, but claims can only be for amounts actually spent. Receipts are not required if the claim does not exceed the ATO’s reasonable amounts, with bank statements considered suitable for substantiation purposes.

The regulator is currently working with trucking industry representatives to develop a daily rate for 2018/19 and simplify record keeping requirements for drivers.