Section 100A – ATO investigates trusts

Section 100A Reimbursement Agreements Update

Section 100A is not a new or changed section of legislation. However, draft rulings issued by the Australian Tax Office (ATO) in February 2022 change how the ATO intends to more harshly apply section 100A.

Where a beneficiary of a trust (e.g. an adult child) is allocated trust income, sometimes, a beneficiary’s present entitlement to a share of trust income arises out of, or in connection with, an arrangement that:

- involves a benefit being provided to another person (e.g. a parent/parents)

- is intended to have the result of reducing someone’s tax liability, and

- is entered into outside the course of ordinary family or commercial dealing.

In these cases, section 100A of the Income Tax Assessment Act 1936 generally applies to make the trustee, rather than the presently entitled beneficiary, liable to tax at the top marginal rate.

The ATO draft rulings represent the ATO looking to attack distributions of income from trusts to beneficiaries where the distributions are not actually paid to the beneficiary in cash, or the cash goes to a different recipient, with the view of obtaining a tax advantage.

Section 100A reimbursement agreements

When a beneficiary is allocated a share of trust income, that share of the trust’s net income is generally assessed (taxed) to the beneficiary of that income. This taxing occurs whether or not they receive the distribution as a cash distribution.

However, to the extent a beneficiary’s entitlement arises out of a reimbursement agreement, section 100A disregards it, and instead, the net income that would otherwise have been assessed to the beneficiary (potentially at a lower rate), is instead assessed to the trustee at the top marginal tax rate.

A reimbursement agreement generally involves making someone presently entitled to trust income in circumstances where both:

- someone other than the presently entitled beneficiary actually benefits from that income, and

- at least one party enters into the agreement for purposes that include getting a tax benefit (whether written or implied).

Common situations the ATO is looking to target in the future are:

- where a trust controlled by a parent/parents makes an allocation of trust income to adult children or other family members such as parents, but the distribution is either paid to the parents instead, or is retained in the trust, and

- circular arrangements whereby a trust distributes to a company, which in turn pays a dividend back to the trust, which then distributes back to the company,

- both with a view to obtaining a tax advantage.

Example: reimbursement agreement

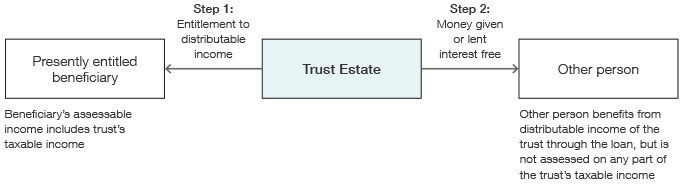

The trustee of a trust estate makes a beneficiary entitled to trust income, e.g.an adult child.

Under an agreement, either written or implied, instead of paying the amount of trust income to the beneficiary, the trustee gives, or lends on interest-free terms, the money to another person, e.g. the parents of that child. The other person benefits from the trust income but is not assessed on any part of it.

Subject to the arrangement being what’s referred to ‘ordinary commercial or family dealings’ (a defined term), this arrangement would generally constitute a reimbursement agreement if it was intended that the beneficiary who was made presently entitled to the trust income pays a lower amount of tax than would have been payable by the person who actually benefitted from that income.

In simple terms, it’s an arrangement whereby trust profit is distributed to a family member, but they don’t received the cash for that distribution. Instead, the cash is either paid to the parent/parents or retained in the trust.

This arrangement is very common with the large use of trust in Australia for family and business dealings.

ATO Deputy Commissioner Louise Clarke said “The vast majority of small businesses operating through a trust are not operating in a way that will attract section 100A. A distribution to an adult child who has a low marginal tax rate will not attract section 100A where they simply receive or enjoy the benefit of their distribution”.

The ATO will not be pursuing taxpayers that entered into arrangements between 1 July 2014 and 30 June 2022 where, in good faith, they concluded that section 100A did not apply to them based on the previous 2014 guidance.

“I want to reassure the community – we won’t have a retrospective element. We stand by our 2014 guidance for this interim period,” Ms Clarke said.

Whilst we await further guidance from the ATO, if you have any questions regarding these measures, please contact your AFS advisor.

What does this mean for you?

AFS will be monitoring the outcome of submissions to the ATO and any changes made to the draft rulings by the ATO and advise on any changes required.