Client update | August 2019

Happy new financial year!

Just like that we have reached the 2019/2020 financial year. If you asked anyone in the 80’s what we could expect in 2020, we assumed we’d all be eating synthetic food pills and being served by robots. In reality, we are mostly the same, with a few technological advances and very expensive smartphones!

Economic update

We are into the final month of an unusually balmy winter, after a record run of high temperatures for July in many states. Financial markets have also been running hot with new records set.

Global sharemarkets were riding high fueled by higher than expected US growth, rising expectations that the US Federal Reserve would cut interest rates this month and hopes of further China-US trade talks.

On the flip side, global bond yields fell to record lows. Australian 10 year government bonds currently yield 1.21%, down 1.45% in 12 months.

Australia’s All Ordinaries Index and ASX200 finally broke through their 2007 record highs set before the Global Financial Crisis. Australian shares were also buoyed by the second cut in official interest rates to a new low of 1%. Rising iron ore prices (up 72% in 12 months) and further falls in the Australian dollar to below US69c also helped boost our export sector.

Australia’s trade surplus rose to a record high of $5.75 billion in May, including a record surplus with China. But in a worrying sign, China’s economic growth fell to an annual rate of 6.2% in the June quarter, its weakest in 27 years.

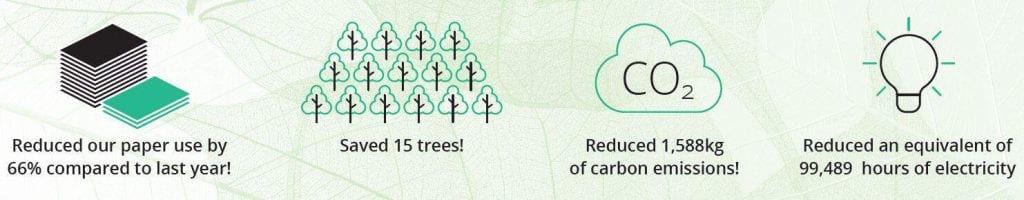

Together we are helping the environment!

Over the past few months our team has been working hard to become a paper light workplace.

If you would like to help us further and switch your correspondence to an electronic format instead of post please contact AFS on 03 5443 0344 to help make our world greener.

In the period from April to July 2019 we have:

Also in this edition:

- Economic update

- Changes to how you receive ATO mail

- Change to group certificate/payment summaries

- Beware of ATO impersonators

- ATO approved logbook apps

- Income tax cuts – how much will you get back?

- Venture – protecting your superannuation

We hope you enjoy this edition of the AFS Client Update. Should you wish to investigate any of these matters further, please contact our office on 03 5443 0344.