Commercial and Industrial Property Tax Reform overview

The Commercial and Industrial Property Tax Reform in Victoria replaces the current stamp duty system for commercial and industrial property transactions. Stamp duty, considered a barrier to business investments, will be progressively eliminated for properties settled from July 1 2024. The reform, endorsed by various inquiries, including the Henry Tax Review and the Productivity Commission, aims to boost business growth by removing upfront costs for around 265,000 commercial and industrial properties.

When will the Commercial and Industrial Property Tax Reform apply

The reform will apply when a property has:

- a property contract of sale is entered into on or after 1 July 2024

- 50 per cent or more of the property ownership is transferred

- you are liable for paying the duty (i.e. not exempt from duty); and

- the property has a qualifying commercial or industrial use at the date of settlement.

A property is considered to have a qualifying commercial or industrial use if it meets one of the following conditions at the settlement date of a property transaction:

- property is allocated an Australian Valuation Property Classification Code (AVPCC) that represents commercial, industrial, extractive industries, or infrastructure and utilities land (included in the 200s, 300s, 400s, and 600s AVPCC categories), or

- property is qualifying student accommodation.

Above guide provided by the Victorian Government.

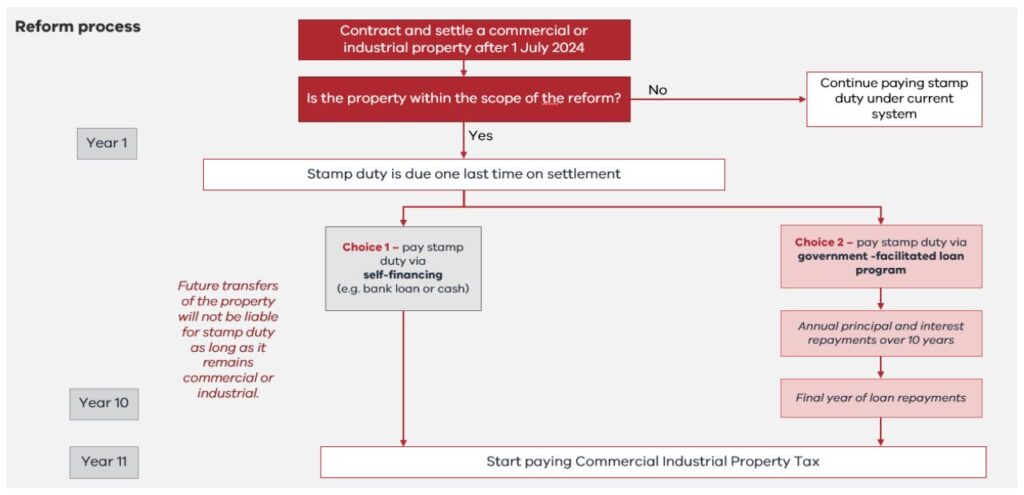

The reform in 5 steps

The Victorian Government has also provided this 5 step guide.

Step 1: The reform will commence on 1 July 2024. People who own residential or primary production property will not be directly affected. People who own commercial and industrial property prior to that date and do not transact will not be directly affected. (If 50 per cent or more of the property is sold, it is considered that the property has transacted).

Step 2: If a commercial/industrial property is contracted on or after that date, at settlement a 10-year transition period will commence for that property. Additionally, at settlement the purchaser will have a choice to either:

- pay the property’s final stamp duty liability as an upfront lump sum; or

- finance stamp duty through a government-facilitated transition loan, allowing them to make annual loan repayments over 10 years – equivalent to the property’s final upfront stamp duty liability plus interest.

Step 3: Stamp duty will not be payable on future transactions of that property, even if it is sold multiple times within the 10-year transition period, if it continues to have a commercial or industrial use. If the property is sold within the 10-year transition period and the initial purchaser opted for a transition loan, they will be obliged to make the remaining repayments prior to settlement of the sale.

Step 4: The Commercial and Industrial Property Tax will start 10 years after the initial transaction, regardless of whether the property has been transacted since. The Commercial and Industrial Property Tax will be set at a flat one per cent of that property’s unimproved land value. It will be separate from and in addition to the existing land tax system.

Step 5: After the 10-year transition period, the property will become liable for the Commercial and Industrial Property Tax. As long as the property is used for a commercial or industrial purpose no stamp duty will be payable on any transaction, and whoever owns that property will be liable for the Commercial and Industrial Property Tax.

Commercial and Industrial Property Tax Reform Tax exemptions

The reform excludes:

- residential properties

- properties used for specific purposes (e.g. primary production, sport, heritage, culture purposes or community services)

- property transfers that are already exempt from stamp duty.

Commercial and industrial properties purchased before July 1 2024, are exempt unless 50% or more of the property is transacted after this date.

Existing concessions for stamp duty on commercial and industrial property will continue. Transfers eligible for the Regional Commercial and Industrial Duty Concession will receive a 50% reduction. Existing land tax exemptions apply to the Commercial and Industrial Property Tax.

Calculation and commencement of Commercial and Industrial Property Tax

The Commercial and Industrial Property Tax will be 1% of the property’s unimproved land value. The tax commences ten years after the first eligible transaction, following the midnight assessment on December 31 each year.

The unimproved land value is calculated with the Capital Improved Value (CIV) standards, where a property represents the assessed value of the land, structures, and any additional capital enhancements on the property, determined through the general valuation process. This value is presented on the property’s council rates notice.

Transition loan option

To alleviate the upfront burden, a government-facilitated transition loan is offered for properties with a purchase price of $30 million or under. The loan, available to eligible purchasers, has a fixed interest rate over ten years, with the first repayment due 12 months after settlement. The loan interest rate is equal to a base rate (based on government borrowing costs) plus a risk margin determined annually by the Treasurer (set at 2.25% for 2024-25).

The loan will be available to eligible applicants, who are:

- Australian citizens/permanent residents or an Australian business

- the first purchaser of a commercial or industrial property where settlement occurs for contracts entered into on or after 1 July 2024

- purchasing property up to a maximum purchase price of $30 million; and

- approved for finance from an Authorised Deposit-taking Institution or other approved lender for the subject property.

Early repayment will be allowed but a break fee will apply.

Upcoming information

Further details on fiscal impacts, legislation, and additional information on the reform are expected to be released before the start date of July 1 2024. You can also access more information on the Victorian Government’s website and read through their information sheet.

Talk to our team at AFS & Associates for more information.