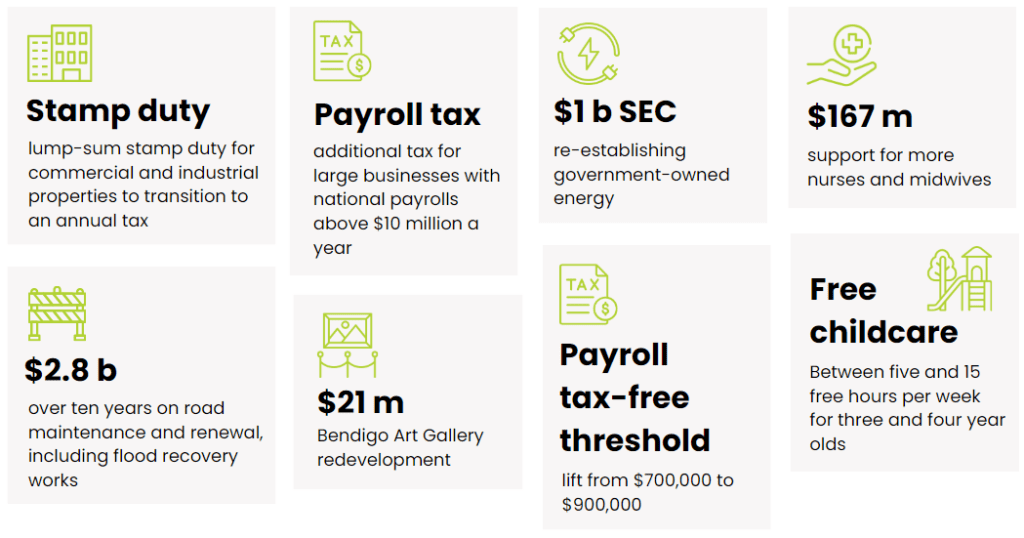

Key takeaways from the 2023-24 Victorian Budget

The recently announced 2023-24 Victoria State Budget announced key changes for businesses small and large. Noteworthy amendments to stamp duty on commercial and industrial properties, payroll tax, land tax, and WorkCover premiums that will affect many businesses and individuals.

Quick links:

- Stamp duty on commercial and industrial properties

- Payroll tax changes

- Property owner land tax changes

- WorkCover premiums

- Budget summary.

Stamp duty on commercial and industrial properties

The lump-sum stamp duty system for commercial and industrial properties will transition to an annual property tax from 1 July 2024.

From the middle of 2024, commercial and industrial properties will transition to the new system as they are sold, with the annual property tax to be payable from 10 years after the transaction.

The Government believes the change will inject $50 billion into the state economy.

Payroll tax changes

Small business

4,200 businesses will benefit from the tax-free threshold lift from $700,000 to $900,000. A further 22,000 businesses will pay a reduced amount of payroll tax. From 1 July 2025, the payroll tax-free threshold will increase again to $1m.

Large business

From 1 July 2023, large businesses with national payrolls above $10 million a year will temporarily pay additional payroll tax. A rate of 0.5 per cent will apply for businesses with national payrolls above $10 million, and businesses with national payrolls above $100 million will pay an additional 0.5 per cent. The additional rates will be paid on the Victorian share of wages above the relevant threshold and are estimated to raise $3.9 billion to repay COVID Debt over four years.

Property owner land tax changes

Designed to raise an estimated $4.7 billion to repay COVID debt over four years, the land tax changes incorporate a temporary additional tax charge.

From 1 January 2024, the tax-free threshold for general land tax rates will temporarily decrease from $300 000 to $50 000. The family home will remain exempt from land tax.

Those who pay land tax will attract a temporary additional fixed charge starting at $500 for landholdings between $50 000 and $100 000. There will be a $975 fixed charge for landholdings above $100 000 and the tax rates will temporarily increase by 0.1 per cent for both general and trust taxpayers with holdings above $300 000 and $250 000 respectively.

WorkCover premiums

WorkCover premiums, paid by employers, are set to increase by more than 40 per cent, taking the rate from 1.27 per cent, to 1.8 per cent of remuneration in an effort to fund claims and modernise WorkCover.

In addition to the premium increase, there will be:

- Establishment of ‘Return to Work Victoria’, to assist people returning to work

- Adjustments to the eligibility for mental injury claims

- Introduction of a whole person impairment threshold of 20%, for claims that receive weekly benefits for more than two and half years.

Budget summary

Business and employment

- Stamp duty reform – the lump-sum stamp duty system for commercial and industrial properties will transition to an annual property tax from 1 July 2024.

- Business insurance duty – to phase out over a 10-year period. The government estimates businesses will save approximately $3,200 on professional indemnity insurance or $2,400 on fire and other special risk insurance over a 10-year period.

- Payroll tax free threshold lift – from $700,000 to $900,000. A further 22,000 businesses will pay a reduced amount of payroll tax. From 1 July 2025, the payroll tax-free threshold will increase again to $1m.

- Large business payroll tax (Debt Levy) – from 1 July 2023, large businesses with national payrolls above $10 million a year will temporarily pay additional payroll tax. A rate of 0.5 per cent will apply for businesses with national payrolls above $10 million, and businesses with national payrolls above $100 million will pay an additional 0.5 per cent. The additional rates will be paid on the Victorian share of wages above the relevant threshold.

- WorkCover premium increase – from 1.27% to 1.8% of remuneration.

Health

- Increased staff funding – $167 million funding to provide support for more nurses and midwives, strengthen nurse to patient ratios and improve public health service staffing levels.

- Urgent care boost – an investment of $46 million to train the next generation of paramedics and introduce specialist paramedic practitioners, providing urgent care faster.

- Medical research – $900 million in medical research and a further $12 million to continue supporting the mRNA industry.

Taxation

Property owner land tax – from 1 January 2024, the tax-free threshold for general land tax rates will temporarily decrease from $300 000 to $50 000. The family home will remain exempt from land tax.

Those who pay land tax will attract a temporary additional fixed charge starting at $500 for landholdings between $50 000 and $100 000. There will be a $975 fixed charge for landholdings above $100 000 and the tax rates will temporarily increase by 0.1 per cent for both general and trust taxpayers with landholdings valued above $300 000 and $250 000 respectively. These changes are estimated to raise $4.7 billion to repay COVID debt over four years.

Education

- Free childcare – Three and four-year-old Victorian children can now access between five and 15 hours of free kinder a week, saving families up to $2,500 per child each year.

- Government schools – $266 million to upgrade 43 government schools across Victoria.

- Low‑fee Independent and Catholic schools – $450 million to support building and upgrading low‑fee Independent and Catholic schools.

- Building Better TAFE Fund – $170 million for the Building Better TAFE Fund, which provides four TAFE projects and establishes the TAFE Clean Energy Fund to improve lifelong education pathways, workforce skills and capacity.

- VET subsidies – $186 million to expand eligibility for VET subsidies, so more Victorians can get the training they need for the jobs they want in high-demand industries.

Transport

- Road blitz – $694 million for a road blitz to upgrade key roads and intersections to improve network efficiency, travel times and road safety.

- Melton Line upgrade – $650 million to upgrade the Melton Line, giving commuters in Melbourne’s West better train services.

- Building new trains – $601 million to buy 23 more VLocity trains to be manufactured in Victoria, supporting local jobs.

- Road maintenance and flood recovery works – $2.8 billion over ten years on road maintenance and renewal, including flood recovery works.

- Regional public fares – $190 million to reduce regional fares across Victoria, by capping fares at metro prices.

Energy

- State Electricity Commission (SEC) – re-establishing government-owned energy and investing in renewables with a $1 billion investment.

- Another round of $250 Energy Saving Bonuses – $400 million to deliver another round of the 250 Power Saving Bonus.

Arts and events

- Live music and community broadcasting boost – $35 million to support live music and community broadcasting, including around 10,000 gigs, getting more artists back on stage through grants for musicians to perform at live music venues as well as for music festivals, big and small.

- Major Events Fund expansion – $23 million to expand the Major Events Fund, promoting Victoria’s calendar of events and strengthening our position as the nation’s top location for major events.

- Bendigo Art Gallery redevelopment – for the community and tourists to access more free and collection‑based exhibitions and displays, $21 million to support a major redevelopment of the Bendigo Art Gallery (over three years).

- Latrobe Valley Authority – $7.3 million to deliver place‑based economic and community development through the Latrobe Valley Authority, and continue the Ladder Step Up and Inclusive Employment Worker Transition programs.

- Bendigo Regional Employment Precinct – $6 million to support the delivery of planning works and infrastructure in the Bendigo Regional Employment Precinct.

Other

- Community sports and recreation – $201 million for new and upgraded community sport and recreation facilities, delivering new sporting spaces the whole community can be proud of and more Victorians can use.

- Digital government services – $90 million to digitise essential government services, streamlining the way people interact with government to make sure Victorians can get the information and support they need faster. These services, delivered by Services Victoria, aim to make it easier to do business in Victoria.

We will continue to update this article as new information comes to light.

If you want to discuss how these changes impact you or your business, please contact us on 03 5443 0344 to speak with our accountants.