The STP reporting clock is ticking: Are you ready?

If you’re a small employer with 19 or fewer staff, the countdown to your first Single Touch Payroll (STP) report has already begun.

The STP regime is a key part of the Australian Taxation Office’s (ATO) plan to digitalise and streamline tax and superannuation reporting, and it intends to make the reports a normal part of doing business in Australia.

But many small business owners are only now starting to realise just how much this new online reporting regime will affect their business. This is a worry, as the reform has been called the “biggest compliance change for employers since the introduction of the GST”.i

So are you ready for your first reporting deadline?

When do I need to report?

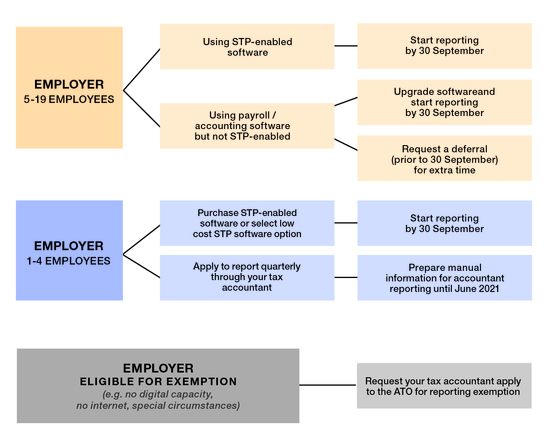

The ATO’s final deadline for the first STP report from small employers (with 19 or fewer employees) is 30 September.

As the introduction of STP is a big change for small employers, the ATO has announced it will be taking a flexible approach to employers’ first report, so you can start reporting any time from 1 July to 30 September 2019 and still be reporting on time.

Once you start reporting, you will be required to send the ATO information about your employees’ salaries and wages, PAYG withholding and superannuation information each pay day (whether it’s weekly, fortnightly or monthly).

Micro businesses (with four or fewer employees) that have a non-computerised payroll may be eligible to report quarterly until 30 June 2021 through their registered tax professional. Quarterly reporting may also be available to businesses providing irregular employment (such as seasonal work).

Employers in a family owned business, company directors and non-business employers (such as carers with a withholding payer number) do not need to start STP reporting until 1 July 2020. This exemption is automatic, but you can start reporting before the deadline.

ATO approach to non-compliance

The ATO has announced it will be taking a ‘light touch’ approach to enforcement during the first 12 months, with no penalties for mistakes or late reports imposed during the first year.

The regulator has guaranteed that no penalties will be applied if an employer gets something wrong and corrects it within an appropriate period, particularly as last minute adjustments often occur with pay loadings and allowances for employees.

Exemptions are available for STP reporting if you are experiencing hardship or operate your business in an area with limited internet capabilities.

The relaxed approach to reporting is unlikely to continue once the STP system is fully up and running. After the first year, all non-exempt employers need to be signed up for STP reporting and, if you are a micro business, you must have applied for quarterly reporting.

Tips for meeting the reporting deadline

With the 30 September deadline fast approaching, here are some tips to ensure your business is prepared for the big day:

- Start reporting straightaway – If you already pay your employees using a digital solution like MYOB, Xero or Quickbooks, moving to STP reporting will be fairly simple, as most software packages are now STP enabled. This means you can start reporting straight away and avoid a last minute rush in September.

- Apply for a deferral – If you currently don’t use the internet or digital software to do the payroll or accounting for your business, you will need to decide whether now is the time to move to a computerised payroll system.If you need more time – or some assistance – before you can start using a computerised system to do your STP reporting, you can apply to the ATO for a deadline deferral to a date no later than 30 June 2020. Requests for a deferred starting date are not automatically granted and you must apply prior to 30 September 2019.

- Talk to us about what you can do – If you are uncertain what to do about STP reporting, contact our office so we can help you plan how to comply with your reporting requirements. This may mean you will need to make changes to your existing business processes, so you have the necessary information available.You can also talk to us or a payroll service provider about completing the necessary reporting on your behalf each pay cycle.

- Sign up for a low-cost digital solution – If you don’t have the necessary payroll or accounting software for reporting an STP pay event to the ATO, the regulator has compiled a list of low cost (less than $10 per month) STP software providers suitable for smaller employers.

If you are thinking about moving to new STP enabled software package, the ATO maintains a list of commercially available solutions.

If you would like to know more about your Single Touch Payroll obligations or how to implement an STP solution, call us today on 03 5443 0344.

i How to get ‘in the zone’ and focus on growing your business, Reckon Software, 2019, https://ddvqhbgjmdkmq.cloudfront.net/wp-content/uploads/sites/2/2019/04/29063947/In-The-Zone-Report.pdf