Processing end of financial year

The end of financial year is only a few days away and there are some important steps to finalise the year in your accounting software.

Make superannuation payments

It is important to ensure Superannuation expenses are paid by close of business Thursday 23 June 2022 to allow five business days for the payments to physically go into the Superannuation fund bank accounts. This needs to happen prior to 30 June for superannuation expenditure to be deductible for the 2022 financial year.

Finalise Single Touch Payroll

Single touch payroll (STP) needs to be finalised and submitted to the Australian Taxation Office once payroll is completed for the year.

Lock your accounting file

To ensure data doesn’t change or be entered into the wrong financial year, it is important to lock your financial years once they are finalised.

We have provided some helpful information to walk you through each of these processes for the four major accounting software programs, MYOB, Quickbooks Online, Reckon and Xero.

End of financial year instructions for MYOB

Processing superannuation in MYOB

Below are instructions on how to process super using the MYOB in-built super portal.

Single Touch Payroll (STP) Finalisation in MYOB

Instead of preparing payment summaries, an STP finalisation event is required to be prepared instead.

Below are instructions on how complete the STP finalisation:

Locking your MYOB file

It’s recommended once the MYOB file is fully reconciled to 30 June 2022 and the above tasks have been processed, that you lock your MYOB file to ensure changes to your data cannot occur.

Below are instructions on how to lock the period:

End of financial year instructions for QuickBooks Online

Processing superannuation in QBO

To process automatic superannuation payments using Beam in QuickBooks Online, please use the details in the following link:

Single Touch Payroll (STP) Finalisation in QBO

Please use the details in the following link to process Single Touch Payroll in QBO Online:

Locking your QBO file

Instructions on how to lock the financial year are included in the following link:

End of financial year instructions for Reckon

Processing superannuation in Reckon

Pay the June quarter superannuation to the superannuation clearing house you ordinarily pay super to, and write a cheque to allocate to the relevant super liability account in Reckon.

You can process your June pay runs in advance or otherwise when you do process the pay runs the super accrued will offset against your early super payment.

This process is no different to how you would ordinarily pay your super liabilities in Reckon, it’s only the timing of the payment that is different.

Single Touch Payroll (STP) Finalisation in Reckon

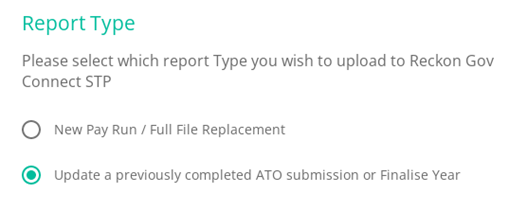

Processing STP finalisations for Reckon accounts and Hosted is the exact same as processing normal STP except you select a few different options when adding the STP File:

When exporting the STP file from the Reckon ‘process STP’ area select Finalise the year rather than new pay event.

In Reckon GovConnect you will also select the corresponding finalise the year option.

You can then approve the file like normal.

You can review the full year amounts uploaded by selecting ‘detail’ on the uploaded pay line to ensure everything looks correct for each employee.

Locking your Reckon file

Instructions on how to lock the financial year are included in the following link:

To do this: You will need to be logged in as Admin and in Single User (if you have multiple users).

- Choose Edit

- Preferences

- Accounting

- Company Preferences

- Closing Date

- Set Date/Password.

End of financial year instructions for Xero

Processing superannuation in Xero

The steps to process both manual and automated superannuation can be followed here:

Single Touch Payroll (STP) Finalisation in Xero

Once all pay runs to the end of 30 June 2022 have been processed, the business needs to lodge a finalisation of single touch payroll (STP) for the year.

Locking your Xero file

The final process after 30 June 2022 is to lock the file to ensure no changes are made to the prior year.

Locking the Xero file should only happen after the following are completed:

- All invoices are entered into the Xero file up to 30 June 2022

- All bills are entered into the Xero file up to 30 June 2022

- All pay runs are posted and STP finalisation has been complete for 30 June 2022

- Any adjustments required are entered into the Xero file prior to 30 June 2022

- All bank, credit cards and loans are reconciled up to 30 June 2022.

To lock the Xero file once the above is complete, follow these steps:

- Select the Accounting drop-down menu at the top of the screen and select Advanced

- Select Financial settings

- Enter the lock date of 30 June 2022 into the lock dates section

- Select Save