2025-26 Federal Budget Summary

2025-26 Federal Budget Summary

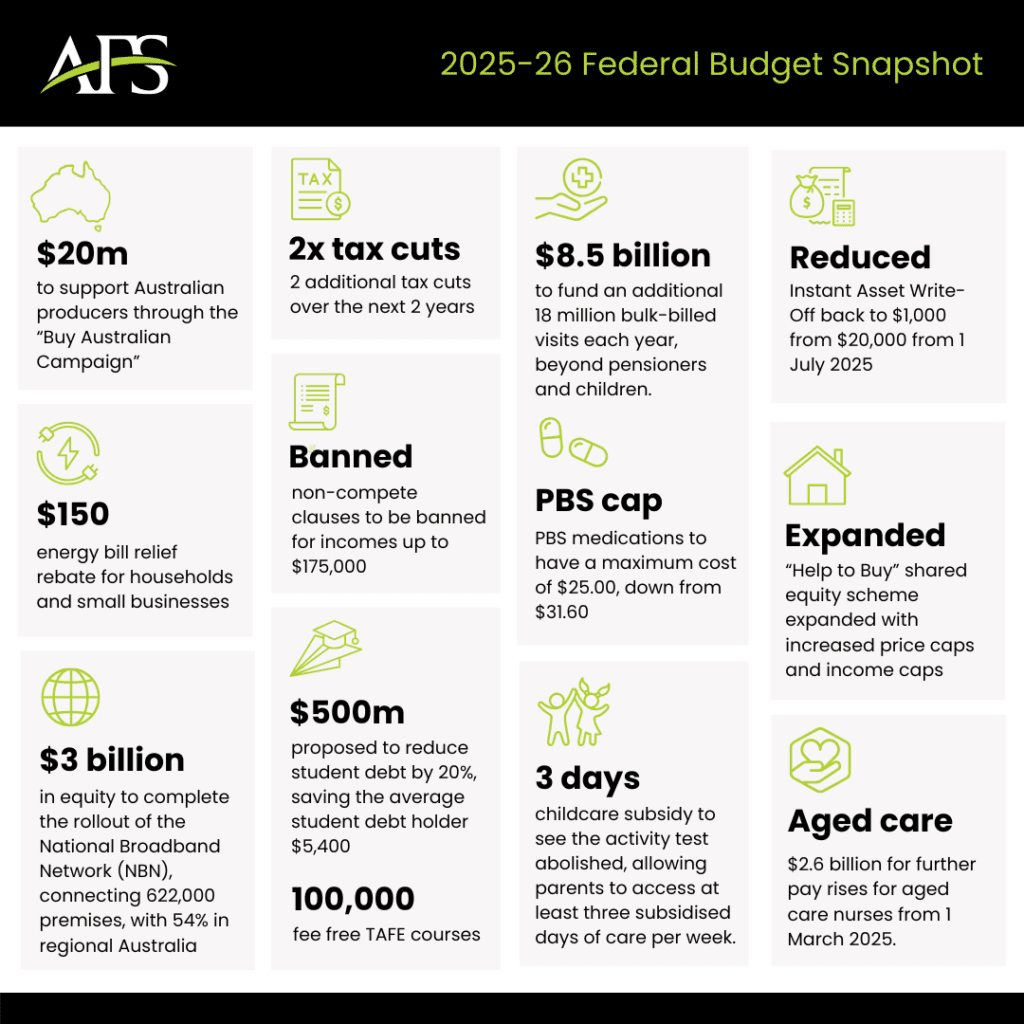

Treasurer Jim Chalmers released the Australian Federal Government’s 2025-26 Budget on the evening of Tuesday 25 March 2025, announcing a $27.6 billion deficit for the 2024-25 financial year.

We’ve summarised some of the major measures announced in the budget below.

Business

Instant Asset Write-Off

This year’s Budget does not include an extension or increase to the Instant Asset Write-Off threshold. After being set at $20,000 in the previous two Budgets, the threshold is set to drop back to $1,000 from 1 July 2025. It’s the first time in ten years the write-off amount hasn’t been lifted.

Energy relief payments for small businesses

Small businesses to see another $150 in rebates automatically applied to their electricity bills in two quarterly instalments of $75 as part of an extension to the existing Energy Bill Relief program.

Support for small business franchisees

An allocation of $7.1 million over two years from 2025–26 to the Australian Competition and Consumer Commission (ACCC) to enhance oversight of the Franchising Code of Conduct and improve transparency and regulation in the franchising sector. An additional $0.8 million will be allocated to developing and consulting on measures to strengthen protections for small businesses under the Franchising Code relating to unfair contract terms and trading practices.

More funding for ASIC to deter illegal phoenixing

$3.0 million over four years from 2025-26 for the Australian Securities and Investments Commission (ASIC) to improve its data analytics capability to better target enforcement activities to deter illegal phoenixing activities, particularly in the construction sector.

Australian Business Registers: further funding and linking DINs to company register

$207 million over two years from 2025-26 to continue the stabilisation of Australia’s business registers and undertake targeted uplifts. This includes linking Director Identification Numbers (DINs) to the Company Register, intended to improve the quality of information available to investors and creditors about directors. It is also intended to further combat illegal phoenixing.

Increased funding for ATO enforcement of taxpayer compliance

$999.0 million over four years for the ATO to extend and expand tax compliance activities, including:

- Expand and extend the Tax Avoidance Taskforce, targeting multinationals and large taxpayers.

- Shadow Economy Compliance Program, addressing under-reporting, illicit tobacco, and worker exploitation.

- Personal Income Tax Compliance Program, focusing on areas of individual non-compliance.

Buy Australian

$20 million to support Australian producers through the Buy Australian Campaign, aiming to encourage consumers to buy Australian made products.

$16 million for a new Australia–India Trade and Investment Accelerator Fund.

Limiting non-compete clauses

Non-compete clauses to be banned from 2027 for workers on up to $175,000 wage. The Government will also close loopholes in competition law that allow businesses to limit pay and conditions or prevent staff from being hired by competitors without workers’ knowledge or consent.

Supermarkets

An allocation of $38.8 million to go to the ACCC to tackle misleading retail pricing and conduct, and $2.9 million to help fresh produce suppliers enforce rights under the now-mandatory Food and Grocery Code, which includes multi-million-dollar penalties for breaches.

$240 million to states and territories to simplify supermarket planning and zoning rules.

Tackling excessive surcharges, unfair practices and scams

$6.7 million funding in 2025–26 to extend the National Anti-Scam Centre, address excessive card surcharges with potential debit surcharge bans, and work with states to ban unfair trading practices and strengthen enforcement of consumer guarantee breaches.

Cleaner, cheaper energy

$8 billion of additional investment in renewable energy and low emissions technologies through a $2 billion expansion of the Clean Energy Finance Corporation.

Unlocking private investment in priority areas

$13.7 billion in hydrogen and critical minerals production tax incentives and has allocated $1.5 billion in support for priority areas through the Future Made in Australia Innovation Fund, including:

- $750 million for green metals

- $500 million for clean energy technology manufacturing capabilities

- $250 million for low carbon liquid fuels.

Front door for investors

A new “Front Door” for investors with major proposals, aiming to simplify the investment process in Australia. Starting in September 2025, it’s to serve as a single entry point offering coordinated support for priority projects, overseen by an Investor Council.

Completing the NBN

$3 billion in equity to complete the rollout of the National Broadband Network (NBN), to provide NBN to a further 622,000 premises, with 54% in regional Australia.

Beer excise indexation on pause

Draught beer excise indexation paused for two years from 1 August 2025. The increases due in Aug 2025, Feb 2026, Aug 2026, and Feb 2027 will not occur. The indexation pause does not apply to beer and spirits sold in bottles and cans.

Support for alcohol producers

An increase to the annual cap for the excise remission and Wine Equalisation Tax rebate from $350,000 to $400,000 for eligible brewers, distillers, and wine producers, will be introduced effective from 1 July 2026. Applies to eligible brewers, distillers, and wine producers from 1 July 2026.

Super guarantee: no change to legislated rate rise

No changes announced to the scheduled increase to the super guarantee (SG) rate, which will rise from 11.5% to 12% on 1 July 2025—its final legislated rate. This completes the gradual 0.5% annual increases since 2020–21, when the rate was 9.5%. Employers should note that they cannot offset the additional 0.5% SG obligation with any salary sacrificed super contributions made by employees.

Personal

Tax cuts

Delivery of two more tax cuts to every Australian taxpayer. The tax cuts decrease the current 16% rate to 15% from 1 July 2026 and 14% from 1 July 2027.

The cuts will reduce tax payable for all taxpayers earning above $45,000 by $268 in the 2027 year and $536 dollars in the 2028 year onwards.

| Income range | 2024/25 & 2025/26 rate | 2026/27 rate | 2027/28 onwards rate |

| $0 – $18,200 | Nil | Nil | Nil |

| $18,201 – $45,000 | 16% | 15% | 14% |

| $45,001 – $135,000 | 30% | 30% | 30% |

| $135,001 – $190,000 | 37% | 37% | 37% |

| $190,001+ | 45% | 45% | 45% |

Superannuation

The Government did not announce any new major superannuation measures in the Budget.

The only super item of note was some additional funding to extend an ATO Tax Integrity Program which is expected to raise an extra $31m in unpaid superannuation from medium and large businesses and wealthy groups over 5 years from 2024-25.

The Budget did not announce any change to the timing of the next (and final) Super Guarantee (SG) rate increase. The SG rate is currently legislated to increase from 11.5% to 12% on 1 July 2025

Medicare Levy

Medicare levy low-income thresholds will be increased from 1 July 2025, again to provide cost-of-living relief. The threshold increases are as follows:

| Taxpayer Category | Current Threshold (2024/25) | New Threshold (2024/25 onwards) |

| Singles | $26,000 | $27,222 |

| Family | $43,846 | $45,907 |

| Single seniors/pensioners | $41,089 | $43,020 |

| Family seniors/pensioners | $57,198 | $59,886 |

| Per dependent child/student | $4,027 | $4,216 |

Pharmaceutical Benefits Scheme (PBS) medication price cap

PBS medications to have a maximum cost of $25.00, down from $31.60, from January 2026. This change is estimated to save Australians a combined $200 million a year, and cost $690 million over the next four years.

Medicare funding

An $8.5 billion Medicare commitment aims to fund an additional 18 million bulk-billed visits each year, as the government seeks to expand free GP access beyond children and pensioners, towards a near-universal system.

Wage increases for childhood education and care workers

$3.6 billion to support a historic wage increase for the early childhood education and care workforce.

Wage increases for aged care nurses

$2.6 billion for further pay rises for aged care nurses from 1 March 2025.

Energy relief payments for every household

Energy rebates extended to the end of 2025, providing households with an additional $150 in bill relief (delivered as two automatic $75 credits on electricity bills).

Small businesses are also eligible for this extended rebate.

Extending subsidies for apprentices and fee-free TAFE

Investments to enhance support for apprentices and training includes:

- Reframe the New Energy Apprenticeships Program into the Key Apprenticeship Program, expanding its focus to include critical residential construction roles including an initiative where from 1 July 2025, eligible tradie apprentices will receive up to $10,000 throughout their studies to encourage more young Australians to work in the housing construction industry.

- $77.8 million to extend the current interim Australian Apprenticeship Incentive System settings for an additional six months, from 1 July to 31 December 2025;

- $11 million to boost the Disability Australian Apprentice Wage Support subsidy;

- $7 million to increase the Living Away From Home Allowance;

- $253.7 million over two years from 2026-27 (and an additional $1.4 billion from 2028-29 to 2034-25) to make Free TAFE a permanent program.

Construction employers and apprentices

Construction employers with apprentices in priority occupations might be eligible for up to $5,000 through the Priority Hiring Incentive, which has been extended for an additional six months, until 31 December 2025.

HECS-HELP debt reduction

The government has committed to reducing HELP or student loan debt by applying a one-off 20% before indexation is next applied on 1 June 2025. This is expected to impact three million people and save the average student debt holder $5,400.

The government will also increase the minimum repayment threshold for HELP and student loan debts from $54,435 in 2024-25 to $67,000 in 2025-26.

Child Care Subsidy Three Day Guarantee

$4.5 million over four years for change to the childcare subsidy to see the activity test abolished, allowing parents to access at least three subsidised days of care each week, regardless of their work or study hours. The three-day guarantee is set to begin in January 2026.

Families earning more than $533,280 will still not be eligible.

Regional banking

The Government has secured commitments from the major banks to continue operating over 800 of their branches in regional and remote Australia until at least 31 July 2027. The banking sector has agreed to increase its investment in Australia Post’s Bank@Post service, providing greater choice for bank customers in approximately 1,800 regional and remote communities.

Expansion of the “Help to Buy” scheme

The “Help to Buy” shared equity scheme, allowing homebuyers to “co-buy” their property with the government and thus reducing the size of the deposit and mortgage needed to buy a home, will expand to be available to more Australians.

The first home buyer needs to contribute at least a 2% deposit. The scheme is capped at 10,000 places a year, with a total of 40,000 places over four years.

Eligibility income caps will also be lifted from $90,000 to $100,000 for individuals and from $120,000 to $160,000 for joint applicants and single parents. This is an extra investment of $800 million into the program.

Enforcing ban on foreign ownership of housing

An investment of $14.6 million over four years to help the ATO and Treasury enforce a two-year ban on foreign residents buying established homes from 1 April 2025, with some exceptions. Additional funding will support a new audit program targeting land banking, ensuring foreign investors develop vacant land within reasonable timeframes.

Defence

The Government’s 2024 National Defence Strategy set in motion a transformation of the Australian Defence Force’s capability, focus and structure. This is underpinned by the Government’s investment of $330 billion in the Defence Integrated Investment Program out to 2033‒34, which will mean that Defence funding will exceed 2.3% of GDP by the early 2030s. This includes a $50.3 billion investment provided in the 2024‒25 Budget.

Australia has already committed more than $1.3 billion in military assistance to Ukraine. This Budget includes further support for more equipment, as well as $36 million over five years from 2024–25 (and $7.8 million per year ongoing) for the Australian Embassy in Kyiv.

$44.6 million initial investment in response to the 2024 Independent Intelligence Review.

$159 billion in maritime capability over the decade which will support over 8,500 jobs by 2030. Additionally, over 20,000 jobs over the next 30 years will be created to support the nuclear-powered submarine program.

Victorian infrastructure

- $2.0 billion for a Sunshine Station upgrade

- $1.0 billion for Victorian “Road Blitz”

- $2.2 million in 2025-26 for redevelopment of the Museum of Chinese Australian History in Melbourne and Golden Dragon Museum in Bendigo.

Where to get Budget documents

The 2025-26 Budget Papers are available from the following website:

Please note that the measures outlined above in the Federal Budget are contingent on Labor being re-elected.