2024-25 Federal Budget Summary

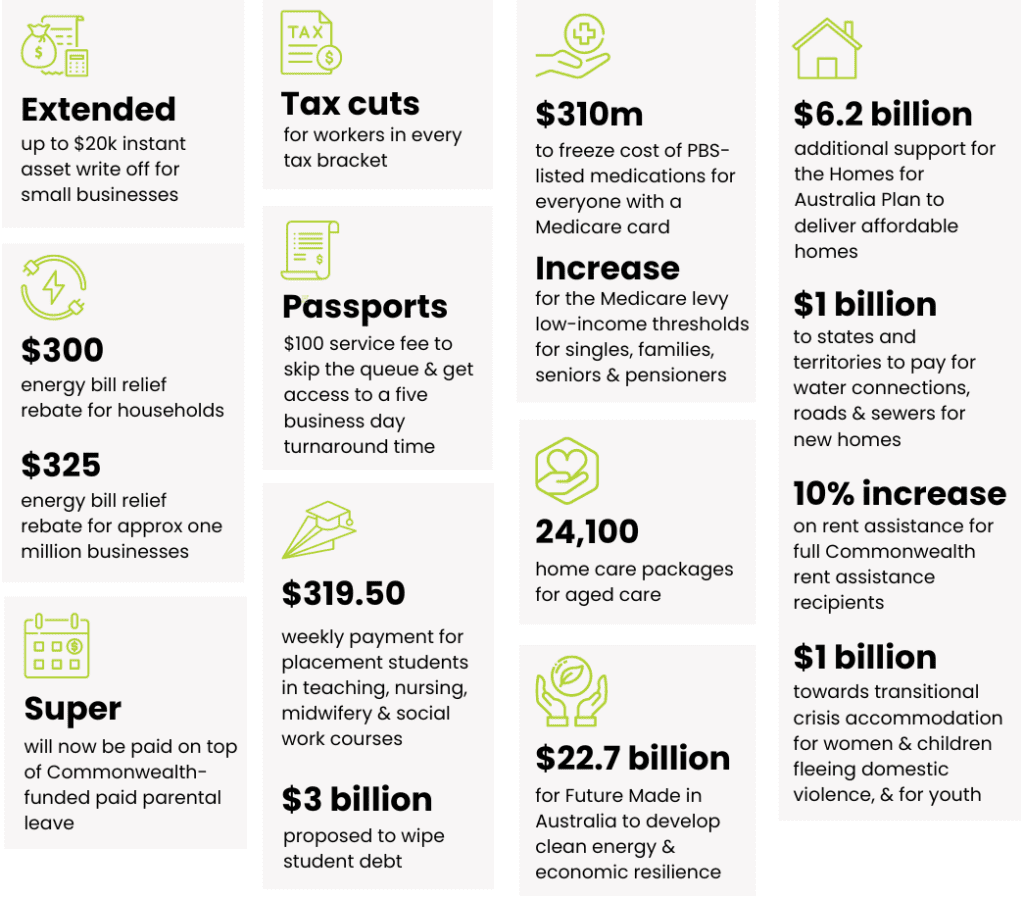

Treasurer Jim Chalmers released the Australian Federal Government’s 2024-25 Budget on the evening of Tuesday 14 May 2024, announcing a budget surplus forecast of $9.3 billion in 2023-24.

The measures included tax incentives for the production of critical minerals and hydrogen to support the Government’s Future Made in Australia agenda to boost business investment. The cost of living has also been targeted with the confirmation of the revised Stage 3 tax cuts, $3.5 billion in energy bill relief (including a $300 energy rebate for individuals and $325 for eligible businesses) and $1.9 billion for increased rent assistance.

While inflation is expected to remain elevated at 3.5% for 2023-24, it is expected to fall to 2.75% in 2024-25 – within the Reserve Bank of Australia’s (RBA) target band of 2-3%. This moderation in inflation (less than half of the 2022 peak) has occurred more quickly than previously anticipated. The Government also believes its energy bill relief and rent assistance measures will directly reduce inflation by 0.5 of a percentage point in 2024-25, and not add to broader inflationary pressures.

The major measures announced in the Budget include the following:

Business

$20,000 instant asset write-off for small business extended

The Government will extend the instant asset write-off concession for small businesses for another 12 months.

Small businesses with annual turnover of up to $10 million can immediately deduct the full cost of eligible depreciating assets priced under $20,000. This applies to assets first used or installed for taxable purposes between 1 July 2024 and 30 June 2025.

Small businesses will be able to instantly write off multiple assets, as the $20,000 threshold will apply on a per-asset basis.

Assets valued at more than $20,000 can continue to be placed into the small business simplified depreciation pool and depreciated at 15% in the first income year and 30% each income year thereafter.

This measure is contained in a Bill which is currently before Parliament and is not yet law.

Energy relief payments

Small businesses that meet their state or territory’s definition of an electricity ‘small customer’ based on their annual electricity consumption threshold (guide below), will be eligible for an annual $325 energy rebate.

| State | Annual electricity consumption threshold for small customers |

| NSW | 100 MWh |

| VIC | 40 MWh |

| QLD | 100 MWh |

| SA | 160 MWh |

| TAS | 150 MWh |

| ACT | 100 MWh |

| NT | 160 MWh |

Business Activity Statement notification period extended

The Government will extend the Australian Taxation Office’s (ATO) notification period for retaining a business activity statement (BAS) refund for further investigation. The mandatory notification period will increase from 14 days to 30 days, aligning it with the time limits for non-BAS refunds.

Countering fraud

$187 million over the next four years will fund the ATO’s capacity to detect, prevent, and address fraud in the tax and superannuation systems. The funding breakdown includes:

- $78.7 million to improve information and communication technologies, allowing real-time detection and blocking of suspicious activities.

- $83.5 million to establish a new taskforce aimed at recovering lost revenue and intervening in fraudulent refund attempts.

- $24.8 million to enhance the ATO’s management and governance of anti-fraud activities, including better support for individuals affected by fraud.

Payday super: no further details but funding to improve unpaid super in bankruptcy

The Budget papers did not reveal any further details on the Government’s proposal to require all employers to pay their employees’ super guarantee at the same time as their salary and wages from 1 July 2026.

However, the Government said it will progress its workplace relations agenda, including:

- Unpaid super in bankruptcy and liquidations: to pursue unpaid superannuation entitlements owed by employers in liquidation or bankruptcy from 1 July 2024.

- Fair Work non-compliance by large corporates: funding for the Office of the Fair Work Ombudsman to continue targeting non-compliance with the Fair Work Act 2009 by large corporate employers.

- Small business support for workplace law changes: boost funding for the Office of the Fair Work Ombudsman to support small business employers to comply with recent changes to workplace laws.

Future Made in Australia incentives

Critical Minerals and Hydrogen Production tax incentives

The Government will provide two tax-related incentives relating to its Future Made in Australia program covering critical minerals production and hydrogen production tax incentives.

There are no specific details in the Budget papers as to how these incentives will be implemented.

Other Future Made in Australia program related measures

Although not related to tax, the expenditure/provision of funding for the program includes the following:

- $1.7 billion funding over 10 years from 2024-25 for investments in innovation, science and digital capabilities;

- $19.7 billion over 10 years from 2024-25 to accelerate investment in Future Made in Australia priority industries, including renewable hydrogen, green metals, low carbon liquid fuels, refining and processing of critical minerals and manufacturing of clean energy technologies including in solar and battery supply chains;

- $17.3 million over 4 years from 2024-25 (and $3.1 million per year ongoing) to promote the development of sustainable finance markets in Australia;

- $182.7 million over 8 years from 2023-24 (and $4.5 million ongoing from 2031-32) to strengthen approval processes to support the delivery of the Government’s Future Made in Australia agenda; and

- $218.4 million over 8 years from 2023-24 (and $1.3 million per year ongoing) to support a Future Made in Australia through the development of a skilled and diverse workforce and trade partnerships.

Personal

Energy relief payments for every household

A $300 energy discount will be applied as a rebate directly to energy bills for every Australian household in the 2024-25 financial year.

Medicare Levy threshold increase

The Government released the 2023-24 Medicare levy thresholds on 25 January 2024 when it announced the revisions to the Stage 3 tax cuts.

| Category | 2022–23 Income Year | 2023–24 Income Year |

| Singles | $24,276 | $26,000 |

| Couples with no children | $40,939 | $43,846 |

| Additional amount per dependent | $3,760 | $4,027 |

| Single seniors and pensioners (SAPTO) | $38,365 | $41,089 |

| Family threshold for seniors and pensioners | $53,406 | $57,198 |

| Additional amount per dependent | $3,760 | $4,027 |

Reducing the cost of medications

Prescription medicines on the Pharmaceutical Benefits Scheme (PBS) will have a maximum cost of $31.60 for the upcoming financial year. For pensioners and concession card holders, the price cap will remain at $7.70 until 31 June 2029.

Additionally, an investment of $3.4 billion has been made to include several new medications on the PBS.

Indexation changes for student debt

The Government has flagged two proposed changes to help with student debt, which require legislative amendments to the Higher Education Support Act 2003.

First, the indexation factor will be the lower of the Customer Price Index (CPI) or the Wages Price Index (WPI). The quarterly WPI measures change in the price of wages and salaries in the Australian labour market over time.

Second, the change will be backdated to 2022–23, meaning the new system will apply to 2022–23, 2023–24 and following years.

This measure is yet to be approved by Parliament and is not yet law.

Super to be paid on Government paid parental leave

Starting 1 July 2025, superannuation will be paid on government-funded paid parental leave (PPL) for births and adoptions, at a rate of 12%.

The Paid Parental Leave Amendment (More Support for Working Families) Act 2024 expands PPL initially by adding an extra two weeks effective 1 July 2024, for a total of 22 weeks. This will increase to 24 weeks in July 2025 and 26 weeks in July 2026.

Super account balances above $3 million

The Budget papers did not reveal any further details on the Government’s proposal to apply an additional 15% tax on superannuation “earnings” (including unrealised capital gains) corresponding to the percentage of an individual’s super balance that exceeds $3m for an income year commencing from 1 July 2025 under the proposed Div 296 and related Bills which are currently before the House of Reps.

Changes to foreign resident Capital Gains Tax (CGT) rules

The Government will amend the following areas of CGT as it applies to foreign residents, to:

- clarify and broaden the types of assets that foreign residents will be liable for;

- amend the point-in-time principal asset test to a 365-day testing period; and

- require foreign residents disposing of shares and other membership interests exceeding $20 million in value to notify the ATO, prior to the transaction being executed.

The amendments will apply to CGT events commencing on or after 1 July 2025 and are estimated to increase receipts by $600 million, and increase payments by $8 million over the 5 years from 2023-24.

New service: Fast-tracked passport applications

From 1 July 2024, Australians will have an option to pay an extra $100 to receive their documents back within five business days. The Government expects this new service will generate an additional $27.4 million in revenue.

Housing

Commonwealth Rent Assistance increase

Approximately 500,000 Australians will receive a 10% increase to their Commonwealth Rent Assistance.

Student housing

The Government will develop regulations with the higher education sector, to require universities to increase their supply of student accommodation.

Social housing and homelessness

$9.3 billion funding for the National Agreement on Social Housing and Homelessness with states and territories.

$1.9 billion in concessional loans to community housing providers and other charities to support delivery of new social and affordable homes under the Housing Australia Future Fund and National Housing Accord.

Health

National Disability Insurance Scheme (NDIS)

$468.7 million has been allocated to strengthen the NDIS following recommendations from the independent NDIS Review. Nearly half of this funding will focus on reforms to prevent widespread fraud, developed in collaboration with people with disabilities.

Funds have also been designated for several key areas:

- $20 million to start consultations to improve system navigation for people with disabilities.

- $5.3 million to enhance pricing transparency.

- Funds to boost governance and policy advisory to implement the reforms.

Additionally, $45.5 million will establish the NDIS Evidence Advisory Committee (NDIS EAC), which will guide the government on future policy implementation.

Mental health

Over the next four years, $361 million will be allocated to fund free mental health services. This funding will enhance 61 Medicare Mental Health Centres, targeting adults with moderate to severe conditions, with completion expected by 30 June 2026.

Additionally, a free digital mental health service is to be launched by 1 January 2026. Australians can access the service without a referral for early-intervention care.

Women’s health

$49.1 million over four years to provide 45-minute consultations for women with complex conditions like endometriosis and pelvic pain.

$56.5 million over four years dedicated to implementing recommendations from the Medicare Benefit Scheme (MBS) Review Taskforce for tailored maternity care.

$56.1 million funding for the Women’s Health Package for several initiatives, including:

- $7 million to support women and families affected by miscarriage or pregnancy loss.

- $12.5 million to enable National Aboriginal Community Controlled Health Organisations to distribute free period products.

- $6 million for outreach healthcare services in crisis accommodation to aid women and children facing family and domestic violence.

Aged care

Home Care Packages

An additional 24,100 Home Care Packages are to be delivered in 2024-25 with a budget of $531.4 million.

Critical digital systems

$1.2 billion allocated to implement the new Aged Care Act and help Australians access aged care information.

Additionally, a free digital mental health service is to be launched by 1 January 2026. Australians can access the service without a referral for early-intervention care.

Where to get Budget documents

The 2024-25 Budget Papers are available from the following website:

- Budget October 2024-25 – https://budget.gov.au/