2022-23 Federal Budget highlights

On Tuesday, 25 October 2022, Treasurer Jim Chalmers handed down the 2022-23 October Federal Budget, his first Budget.

While a Budget was handed down on 29 March 2022, this second Budget for 2022-23 updates economic forecasts and outlines the new Labor Government’s priorities following the May 2022 Federal election.

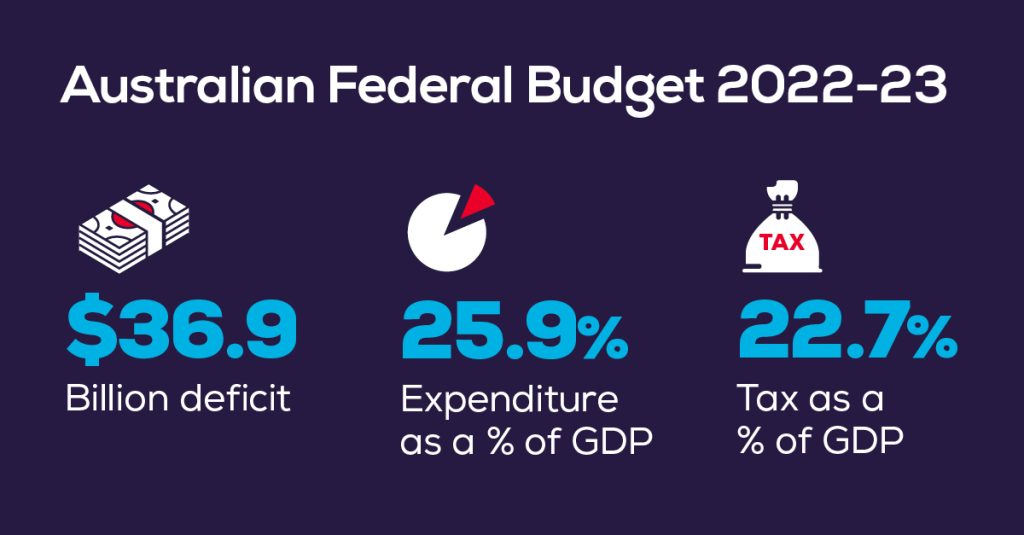

The Budget estimates an underlying cash deficit of $36.9 billion for 2022-23 (and $44bn for 2023-24). While the economy is expected to grow by 3.25% in 2022-23, it is predicted to slow to 1.5% for 2023-24, a full percentage point lower than forecast in March 2022. Inflation is expected to peak at 7.75% later in 2022, but is projected to moderate to 3.5% through 2023-24, and return to the Reserve Bank’s target range in 2024-25.

Against this backdrop, the Treasurer has sought to exercise fiscal “restraint” so as not to put more pressure on prices, and make the Reserve Bank’s job even harder. Rather, the Budget sets out a 5-point plan for cost-of-living relief in the areas of:

Child care

Expanding paid parental leave

Medicines

Housing

Getting wages moving

BUDGET IN SUMMARY

Tax-related measures announced

- Intangible assets depreciation – reversal of previously announced option to self-assess effective life for certain intangible assets (eg intellectual property and in-house software). The effective lives of such assets will continue to be set by statute.

- Previously announced measures – the Government has announced that it will abandon eight measures announced by the previous Government, and defer the start date of three others. Most of the measures relate to business taxation, superannuation and personal tax measures.

- Digital currencies not a foreign currency – the Budget Papers confirm that the Government is to introduce legislation to clarify that digital currencies (such as Bitcoin) continue to be excluded from the Australian income tax treatment of foreign currency.

- Off-market share buy-backs – the Government intends to align the tax treatment of off-market share buy-backs undertaken by listed public companies with the treatment of on-market share buy-backs.

- COVID grants treated as NANE – the Budget Papers contain a listing of further State and Territory COVID-19 grant programs eligible for non-assessable, non-exempt treatment.

- Penalty unit increase – the Government will increase the amount of the Commonwealth penalty unit from $222 to $275 from 1 January 2023.

- Tax Practitioners Board funding – the TPB will get increased funding to investigate high-risk tax practitioners and unregistered preparers.

Superannuation

- SMSF residency changes – the proposal to extend the CM&C test safe harbour from 2 to 5 years, and remove the active member test, will now start from the income year commencing on or after assent to the enabling legislation (previously 1 July 2022).

- SMSF audits every 3 years – the Government will not proceed with the former government’s proposal to allow a 3- yearly audit cycle for SMSFs with a good compliance history.

- Retirement income products – the Government will not proceed with the proposal to report standardised metrics in product disclosure statements.

Other measures

- Affordable housing measures – the Government will establish a Regional First Home Buyers Guarantee Scheme and a Housing Australia Future Fund.

- Housing Accord – struck between State and Territory governments and investors, including super funds, targeting 1 million new homes over 5 years from 2024. The Government will commit $350m over 5 years to deliver 10,000 affordable dwellings.

- Paid Parental Leave (PPL) scheme – to be expanded from 1 July 2023 so that either parent can claim the payment. From 1 July 2024, the scheme will be expanded by two additional weeks a year until it reaches a full 26 weeks from 1 July 2026.

- Child care subsidy – maximum CCS rate to be increased from 85% to 90% for families for the first child in care and increase the CCS rate for all families earning less than $530,000 in household income.

- Helping enable electric car purchases – Fringe benefits tax and import tariffs will not apply for the purchase of battery, hydrogen, or plug-in hybrid cars with a retail price below $84,619 after 1 July 2022.

Revenue and expenditure forecasts

- Total 2022-23 revenues are estimated at $607.2 billion (24.5% of GDP), compared with pre-election update forecasts of $548.5 billion (23.8% of GDP).

- Expenses are seen at $644.1 billion (25.9% of GDP), compared with April forecasts of $626.5 billion (27.2% of GDP).

Debt

- Gross debt for 2022-23 is estimated at $927 billion (37.3% of GDP). Net debt is $572.2 billion (23% of GDP).

- Gross debt for 2025-26 is estimated at $1,159 billion (43.1% of GDP). Net debt is $766.8 billion (28.5% of GDP).

- Interest payments are the fastest growing payment in the Budget, increasing on average by 14.4% per year over the next decade.

Commodity prices

- Key commodity prices are assumed to decline from current elevated levels by the end of the March quarter 2023.

Savings measures

- $22.0 billion in spending reductions or reprioritisations.

- $3.7 billion from extending the Tax Avoidance Taskforce, Shadow Economy, and Personal Income Taxation Compliance programs to improve the integrity of the tax system.

- $952.8 million through action to enforce tax payment by multinationals.

Families

- $4.6 billion to increase Child Care Subsidy rates to make early childhood education and care more affordable for eligible families.

- $531.6 million to expand the Paid Parental Leave Scheme, part of changes to increase the number of weeks available to families to 26 weeks in 2026.

- $1.7 billion to support implementation of the new National Plan to End Violence Against Women and Children.

Housing

- $350 million over 5 years towards Housing Accord setting aspirational goal of 1 million new homes.

- Establishing $10 billion Housing Australia Future Fund to provide new social housing and affordable housing.

Defence/aid

- Defence funding will increase by 8% in 2022-23 and rise to more than 2% of GDP over the forward estimates.

- $1.4 billion in additional Official Development Assistance over 4 years, including $900 million to increase support to the Pacific region and $470.0 million to increase support to Southeast Asia.

Education

- 480,000 fee-free TAFE and community-based vocational education places.

Health

- $235 million to commence the rollout of Urgent Care Clinics.

- Maximum co-payment under the Pharmaceutical Benefits Scheme (PBS) will decrease from $42.50 to $30 per script from 1 January.

- $1.4 billion for new and amended listings, including treatments for various types of cancer and growth hormone deficiency in children.

First Nations Peoples

- $75.1 million to prepare for referendum to enshrine a First Nations Voice to Parliament in the Constitution.

- $314.8 million to support First Nations peoples’ health and well-being outcomes.

- $100 million for housing and essential infrastructure in Northern Territory homelands and $99 million to support improved justice outcomes.

Infrastructure

- $8.1 billion to deliver on key infrastructure projects including the Suburban Rail Loop East in Melbourne, the Bruce Highway and other important freight highways such as the Tanami Road and Dukes Highway.

- $2.4 billion to extend full-fibre access to 1.5 million additional premises, including to over 660,000 in regional Australia.

- $250 million will be provided to expand the Local Roads and Community Infrastructure Program.

- $150 million to upgrade regional airports and their precincts.

- $1.9 billion Powering the Regions Fund to support transition of regional industries to net zero.

- $1.2 billion to advance regional telecommunications.

Climate/Environment

- $345 million to exempt eligible electric cars from fringe benefits tax and the 5% import tariff.

- $204 million to lift total government investment in the Great Barrier Reef to $1.2 billion by 2030. $1.1 billion for the next phase of Natural Heritage Trust funding.

- $224.5 million to establish the Saving Native Species Program.

- $117.1 million to restore funding for environmental assessments.

Biosecurity

- $75.6 million to bolster biosecurity system against escalating animal disease risks.

- $11.7 million to increase detector dog capability.

Disaster support

- Provision of $3 billion in the contingency reserve to meet disaster recovery costs from this year’s floods.

- Invest up to $200 million per year on disaster prevention and resilience through the Disaster Ready Fund.

- $22.6 million to address insurance affordability and availability issues driven by natural disaster risk.

Federal Integrity Commissioner

- $262.6 million to establish and support the Commission, which will focus on detecting and investigating serious or systemic federal corruption.

BUDGET IN DETAIL

Personal Taxation

Personal tax rates unchanged for 2022-23; Stage 3 start from 2024-25 unchanged

In the Budget, the Government did not announce any personal tax rates changes. The Stage 3 tax changes commence from 1 July 2024, as previously legislated.

Resident rates and thresholds for 2022-23

A summary of the 2022-23 tax rates and income thresholds for residents (unchanged from 2021-22) and then Stage 3 rates and thresholds from 2024-25 onwards are:

| Rate | 2022-23 to 2023-24 | From 1 July 2024 (unchanged) |

|---|---|---|

| Nil | $0 – $18,200 | $0 – $18,200 |

| 19% | $18,201 – $45,000 | $18,201 – $45,000 |

| 30% | N/A | $45,001 – $200,000 |

| 32.5% | $45,001 – $120,000 | N/A |

| 37% | $120,001 – $180,000 | N/A |

| 45% | $180,001+ | $200,001+ |

| Low and middle income tax offset (LMITO) | N/A | N/A |

| Low income tax offset (LITO) | Up to $700 | Up to $700 |

Low income tax offsets – LMITO not extended to 2022-23

The 2022-23 October Budget did not announce any extension of the Low and Middle Income Tax Offset (LMITO) to the 2022-23 income year. The LMITO has now ceased and been fully replaced by the Low Income Tax Offset (LITO).

With no extension of the LMITO announced in the October Budget, 2021-22 was the last income year for which the offset was available. As a result, low-to-middle income earners may see their tax refunds from July 2023 reduced by between $675 and $1,500 (for incomes up to $90,000 but phasing out up to $126,000), all other things being equal.

Low income tax offset for 2022-23 (unchanged)

For completeness, and as a reminder, low and middle income taxpayers are entitled to one or two offsets: LMITO (until the 2021-22 income year) and the low income tax offset (LITO). No changes were made to the LITO in the 2022- 23 October Budget. The LITO will continue to apply for the 2022-23 income years and beyond.

BUSINESS TAXATION

Thin cap: new earnings-based tests for limiting debt deductions

Under the current thin capitalisation rules, a non-financial entity’s allowable debt (interest) deductions in relation to its cross- border investments are limited by the application of a number of statutory tests under which its maximum allowable debt is the greatest of:

- the safe harbour debt amount (60% of the average value of the entity’s Australian assets);

- the arm’s length debt amount; or

- the worldwide gearing debt amount which allows the entity to gear its Australian operations up to 100% of the actual gearing of its worldwide group.

The Government will replace the safe harbour and worldwide gearing tests with earnings-based tests to limit debt deductions in line with an entity’s profits.

More specifically, the thin cap rules will be amended to:

- replace the safe harbour test with a new earnings-based test which under which an entity’s debt-related deductions will be limited to 30% of profits (using EBITDA as the measure of profit);

- allow deductions denied under the EBITDA test to be carried forward and claimed in a subsequent income year (up to 15 years);

- replace the worldwide gearing test and allow an entity in a group to claim debt deductions up to the level of the worldwide group’s net interest expense as a share of earnings (which may exceed the 30% EBITDA ratio).

The arm’s length debt test will be retained as a substitute test which will apply only to an entity’s external (third party) debt, disallowing deductions for related party debt under this test.

The changes will apply to multinational entities operating in Australia and any inward or outward investor. Financial entities and ADIs will continue to be subject to the existing thin capitalisation rules.

Date of effect:

The new tests will apply to income years commencing on or after 1 July 2023.

Intangible assets depreciation: option to self-assess effective life dropped

The Government will not proceed with the proposal to allow taxpayers to self-assess the effective life of intangible depreciating assets. The measure was announced in the 2021-22 Budget and was to apply to assets acquired from 1 July 2023. This means that effective lives of intangible depreciating assets will continue to be set by statute, ie reversing this decision will maintain the status quo.

Off-market share buy-backs: proposed integrity rules

The Government intends to align the tax treatment of off-market share buy-backs undertaken by listed public companies with the treatment of on-market share buy-backs.

There is no detail in the Budget Papers nor in any associated media releases on the night as to what precisely is intended.

We will share more information on this matter as it comes to hand.

Helping enable electric car purchases

For purchases of battery, hydrogen, or plug-in hybrid cars with a retail price below $84,619 (the luxury car tax threshold for fuel efficient vehicles) after 1 July 2022, fringe benefits tax and import tariffs will not apply. Note: Employers will still need to account for the cost in an employee’s reportable fringe benefits.

Tax transparency: new reporting requirements

The Government will introduce reporting requirements to enhance the tax information made available to the public. The Government will require:

- significant global entities to prepare for public release tax information on a country by country (CbC) basis and a statement on their approach to taxation, for disclosure by the ATO;

- Australian public companies (listed and unlisted) to disclose information on the number of subsidiaries and their country of tax domicile; and

- tenderers for Australian Government contracts worth more than $200,000 to disclose their country of tax domicile (by supplying their ultimate head entity’s country of tax residence).

Date of effect:

These new reporting requirements will apply for income years commencing from 1 July 2023.

Increased funding for ATO compliance programs

The Government will increase funding for the ATO in the following areas. The moral for taxpayers and their advisors is that the ATO will be getting better and better at detecting variances which will require explanation. Areas of focus are:

Personal Income Taxation Compliance Program

This will focus on key areas of non-compliance, including overclaiming of deductions and incorrect reporting of income. The funding will enable the ATO to modernise its guidance products, engage earlier with taxpayers and tax agents and target its compliance activity.

Tax Avoidance Taskforce

The boosting and extension of the Tax Avoidance Taskforce will support the ATO to pursue new priority areas of observed business tax risks, complementing the ongoing focus on multinational enterprises and large public and private businesses.

Modernising Business Registers

In a slightly different category to the above, the Government will provide additional funding of $166.2 million over four years from 2022-23 to continue delivery of the Modernising Business Registers program that will consolidate over 30 business registers onto a modernised registry platform.

Funding includes:

- $80.0 million in 2022-23 for the ATO and ASIC to continue design and delivery of the modernised registry platform;

- $86.2 million over four years from 2022-23 ($119.5 million over 6 years from 2022-23 and $15.9 million per year ongoing) for ATO and ASIC to operate and regulate the Director Identification Numbers regime, and maintain ASIC’s registry systems.

Penalty unit to increase 1 January 2023

The Government will increase the amount of the Commonwealth penalty unit from $222 to $275, from 1 January 2023. The increase will apply to offences committed after the relevant legislative amendment comes into force.

COVID grants declared as NANE

The Government has made the following State and Territory COVID-19 grant programs eligible for non-assessable, non- exempt (NANE) treatment, which will exempt eligible businesses from paying tax on these grants.

- Business Costs Assistance Program Four – Construction (Victoria);

- Licenced Hospitality Venue Fund 2021 – July Extension (Victoria);

- License, Hospitality Venue Fund 2021 – Top Up Payments (Victoria); Business Costs Assistance Program Round Two – Top Up (Victoria); Business Costs Assistance Program Round Three (Victoria);

- Business Costs Assistance Program Round Four (Victoria); Business Costs Assistance Program Round Five (Victoria);

- Impacted Public Events Support Program Round Two (Victoria);

- Live Performance Support Program (Presenters) Round Two (Victoria); Live Performance Support Program (Suppliers) Round Two (Victoria); Commercial Landlord Hardship Fund 3 (Victoria);

- HOMEFRONT 3 (ACT); and

- Small Business Hardship Scheme (ACT).

Digital currencies not foreign currency

The Government is to introduce legislation to clarify that digital currencies (such as Bitcoin) continue to be excluded from the Australian income tax treatment of foreign currency. The measure has already been released in draft legislation.

By way of background and as a reminder, this will maintain the current tax treatment of digital currencies, including the CGT treatment where they are held as an investment. This measure removes uncertainty following the decision of the Government of El Salvador to adopt Bitcoin as legal tender and will be backdated to income years that include 1 July 2021.

The exclusion does not apply to digital currencies issued by, or under the authority of, a government agency, which continue to be taxed as foreign currency.

SUPERANNUATION

SMSF residency changes delayed

The Government confirmed that the changes to the SMSF residency rules, previously announced in the 2021-22 Budget to commence from 1 July 2022, will now start from the income year commencing on or after the date of assent of the enabling legislation (yet to be introduced).

These measures propose to relax the SMSF residency rules by extending the central management and control test safe harbour from two to five years, and removing the active member test for both SMSFs and small APRA funds. Until this 2021-22 Budget measure is enacted, SMSF trustees need to ensure that they satisfy the current requirements. Even if the CM&C safe harbour is extended to five years from the date of assent, an SMSF trustee still needs to establish (before they leave) that their planned absence from Australia will be ”temporary”.

Three-year cycle for SMSF audits will not proceed

The Government will not proceed with the former government’s proposal to change the annual audit requirement for certain self-managed superannuation funds (SMSFs) to allow a 3-yearly cycle for funds with a history of good record-keeping and compliance.

Standardised disclosure for retirement income products

The Government also announced that it will not proceed with the proposal to report standardised metrics in product disclosure statements (PDS) for retirement income products.

Other outstanding super measures

While not mentioned in the Budget papers, it is worth noting that the Labor Government is yet to provide an update on the status of a number of other superannuation measures announced by the former Government, including:

- Legacy income streams

- Non-arm’s length expenses (NALE)

- SMSF accounts and statements

- Comprehensive income product for retirement (CIPR); or

- Victims of crime access to superannuation.

Super downsizer contributions eligibility age reduction to 55 confirmed

The Government confirmed its election commitment that the minimum eligibility age for making superannuation downsizer contributions will be lowered to age 55 (from age 60).

This measure will have effect from the start of the first quarter after assent to the enabling legislation.

The proposed reduction in the eligibility age will allow individuals aged 55 or over to make an additional non-concessional contribution of up to $300,000 from the proceeds of selling their main residence outside of the existing contribution caps. Either the individual or their spouse must have owned the home for 10 years.

As under the current rules, the maximum downsizer contribution is $300,000 per contributor (ie $600,000 for a couple), although the entire contribution must come from the capital proceeds of the sale price. A downsizer contribution must also be made within 90 days after the home changes ownership (generally the date of settlement).

Assets test exemption for two years; deeming rates frozen

The Government also confirmed its election commitments that seek to assist pensioners looking to downsize their homes, by:

- extending the social security assets test exemption for principal home sale proceeds from 12 months to 24 months;

- changing the income test to apply only the lower deeming rate (0.25%) to principal home sale proceeds when calculating deemed income for 24 months after the sale of the principal home.

Date of effect:

Commencing 1 January 2023 (or 1 month after the day the Bill receives the assent).

OTHER MEASURES

Regional First Home Buyers Guarantee Scheme; Housing Australia Future Fund; other housing measures

The Government has announced that it will establish the “Regional First Home Buyers Guarantee”. Its aim will be to encourage home ownership in regional locations.

It will apply to eligible citizens and permanent residents who have lived in a regional location for more than 12 months to purchase their first home in that location with a minimum 5% deposit. It aims to reach 10,000 places per year to 30 June 2026.

In other measures, the Government will invest $10 billion in the newly created “Housing Australia Future Fund”, to be managed by the Future Fund Management Agency. Its aim will be to generate returns to fund the delivery of 30,000 social and affordable homes over five years and allocate $330 million for acute housing needs.

Paid parental leave to be expanded

The Government will expand the Paid Parental Leave (PPL) scheme from 1 July 2023 so that either parent is able to claim the payment and both birth parents and non-birth parents are allowed to receive the payment if they meet the eligibility criteria. Parents will also be able to claim weeks of the payment concurrently so they can take leave at the same time.

From 1 July 2024, the Government will start expanding the scheme by two additional weeks a year until it reaches a full 26 weeks from 1 July 2026. Both parents will be able to share the leave entitlement, with a proportion maintained on a “use it or lose it” basis, to encourage and facilitate both parents to access the scheme and to share the caring responsibilities more equally. Sole parents will be able to access the full 26 weeks.

The amount of PPL available for families will increase up to a total of 26 weeks from July 2026, benefiting over 180,000 families each year. An additional two weeks will be added each year from July 2024 to July 2026, increasing the overall length of PPL by six weeks.

To further increase flexibility, from July 2023 parents will be able to take Government-paid leave in blocks as small as a day at a time, with periods of work in between, so parents can use their weeks in a way that works best for them.

Further changes to legislation will also support more parents to access the PPL scheme. Eligibility will be expanded through the introduction of a $350,000 family income test, which families can be assessed under if they do not meet the individual income test. Single parents will be able to access the full entitlement each year. This will increase support to help single parents juggle care and work.

Child care measures: increased CCS rate for household income up to $530,000

The Government will provide $4.7bn over 4 years from 2022-23 (and $1.7bn per year ongoing) to deliver cheaper child care and reduce barriers to workforce participation. This includes $4.6bn over 4 years from 2022-23 to:

- increase the maximum Child Care Subsidy (CCS) rate from 85% to 90% for families for the first child in care and increase the CCS rate for all families earning less than $530,000 in household income. From July 2023, CCS rates will lift from 85% to 90% for families earning less than $80,000. Subsidy rates will then taper down one percentage point for each additional $5,000 in income until it reaches 0% for families earning $530,000. Families will continue to receive existing higher subsidy rates for their second and subsequent children aged five and under in care, up to 95%;

- maintain current higher CCS rates for families with multiple children aged five or under in child care, with higher CCS rates to cease 26 weeks after the older child’s last session of care, or when the child turns six years old;

- task the ACCC to undertake a 12 month inquiry into the cost of child care and the Productivity Commission to conduct a comprehensive review of the child care sector to improve the transparency of the child care sector by requiring large providers to publicly report CCS-related revenue and profits.

The Government will also provide $43.9m over four years from 2022-23 for measures to improve early childhood outcomes for First Nations children.

Pension supplement changes for departures overseas will not proceed

The Government will not proceed with the Pension Supplement changes announced by the previous Government in the 2016- 17 MYEFO to the payment of the Pension Supplement for permanent departures overseas and temporary absences.

PREVIOUSLY ANNOUNCED MEASURES: 8 ABANDONED, 3 DEFERRED

The Government has reviewed a number of tax and superannuation related measures that had been announced by the previous Government, but not enacted. It states in the Budget papers that it will abandon 8 of these, while 3 will have deferred start dates.

Finance-related proposals

The following finance-related proposed changes have been abandoned.

- The 2013-14 MYEFO measure that proposed to amend the debt/equity tax rules.

- The 2016-17 Budget measure that proposed changes to the taxation of financial arrangements (TOFA) rules

- The 2016-17 Budget measure that proposed changes to the taxation of asset-backed financing arrangements

- The 2016-17 Budget measure that proposed introducing a new tax and regulatory framework for limited partnership collective investment vehicles

- TOFA technical amendments: start date deferred. The 2021-22 Budget measure that proposed making technical amendments to the TOFA rules has deferred from 1 July 2022 to the income year commencing on or after the date of assent of the enabling legislation.

Superannuation and retirement

The following proposed superannuation and retirement related measures have been abandoned.

- The 2018-19 Budget measure that proposed changing the annual audit requirement for certain SMSFs.

- The 2018-19 Budget measure that proposed introducing a requirement for retirement income product providers to report standardised metrics in product disclosure statements.

Residency requirements for certain SMSFs: start date deferred

The 2021-22 Budget measure that proposed relaxing residency requirements for SMSFs will be deferred from 1 July 2022 to the income year commencing on or after the date of assent of the enabling legislation.

More information and background on these superannuation proposals can be found under the “Superannuation” heading in this summary.

Tax compliance: third-party reporting rules for EDPs, cash payments

The Government intends to defer the start date for the following proposed third-party reporting rules:

- transactions relating to the supply of ride sourcing and short-term accommodation – from 1 July 2022 to 1 July 2023; and

- all other reportable transactions (including but not limited to asset sharing, food delivery and tasking-based services) from 1 July 2023 to 1 July 2024.

It proposes to extend the third-party reporting regime to the operators of electronic distribution platforms that facilitate supplies from one entity to another entity. It will cover platforms operating over the internet, including through applications, websites or other software. However, a service will not be considered to be an electronic distribution platform if it only advertises or creates awareness of possible supplies, operates as a payment platform or serves a communications function.

Transactions will need to be reported to the ATO if they involve the provision of consideration by a buyer to a seller for a supply made through the platform by the seller. Transactions that only involve the sale of goods or real property (the transfer of legal title to the goods or real property) or financial supplies will not be captured. The supply must also be connected to the indirect tax zone (ie Australia).

Cash payments proposal abandoned

In addition, the 2018-19 Budget measure that proposed introducing a limit of $10,000 for cash payments made to businesses for goods and services (and for which a delayed start date was announced in 2018-19 MYEFO) has been abandoned.

Deductible gifts: pastoral care in schools

The 2021-22 MYEFO measure that proposed establishing a deductible gift recipient category for providers of pastoral care and analogous well-being services in schools has been abandoned.

Where to from here?

If you would like assistance understanding how announcements in this Budget impact you, please contact your AFS accountant or our office on 03 5443 0344.

The 2022-23 Budget Papers are available from the following website: