2022-2023 Federal Budget highlights

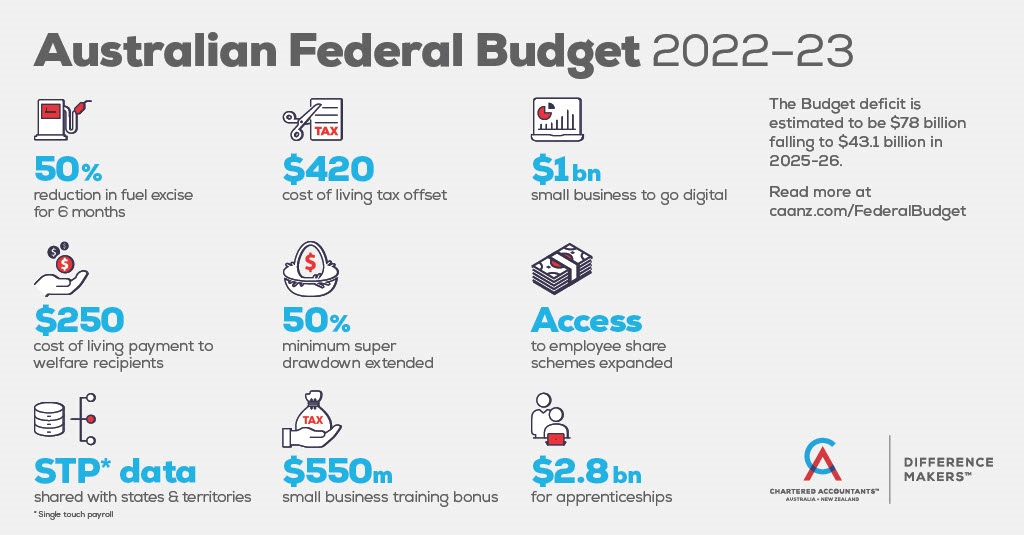

On Tuesday, 29 March 2022, Treasurer Josh Frydenberg handed down the 2022-23 Federal Budget.

In an election Budget, the Treasurer announced a range of cost of living measures, including a one-off $420 cost of living tax offset for low and middle income earners, and a $250 payment for pensioners and welfare recipients. The fuel excise will also be reduced by 50% for 6 months, starting from midnight on 29 March.

For small businesses, a Skills and Training Boost will provide a new 20% bonus deduction for eligible external training courses for upskilling employees from Budget night. In addition, businesses will receive a similar 20% bonus deduction for expenditure on digital technologies (eg cloud computing, eInvoicing, cyber security and web design) for investments of up to $100,000 per year.

The Treasurer said a strong economic recovery is well underway, notwithstanding the COVID-19 pandemic and recent events including floods and the Russian invasion of Ukraine. Economic growth forecasts have been revised upwards, driven by stronger-than-expected momentum in the labour market and consumer spending. The unemployment rate has also fallen to 4%, and is expected to reach 3.75% in the September 2022 quarter.

IN SUMMARY

Tax-related measures announced

The major tax-related measures announced in the Budget included:

- Low and Middle Income Tax Offset (LMITO) increased by $420 for 2021-22 – a one-off $420 cost of living tax offset for the 2021-22 income year will see the LMITO increased up to a maximum of $1,500 for 2021-22 only (up from $1,080). The Government did not announce an extension of the LMITO beyond 2021-22 when it is legislated to cease.

- Personal tax rates – no changes were made to the personal tax rates for 2022-23. The Stage 3 personal income tax cuts remain unchanged and will commence in 2024-25 as already legislated.

- Small business 20% deduction boost: skills training and digital adoption – businesses with turnover less than $50m will receive a 20% uplift on deductions for eligible expenditure on external training courses and digital technology. The 20% boost will apply to eligible expenditure incurred from 7:30pm on 29 March 2022 until 30 June 2024 (for skills training) and 30 June 2023 (for digital adoption).

- Patent box income extended – the concessional tax treatment for eligible corporate income associated with new patents in the medical and biotechnology sectors will be extended to corporate taxpayers who commercialise their: (i) eligible patents linked to agricultural and veterinary chemical products; and (ii) patented technologies which have the potential to lower emissions.

- Employee share schemes – for company law purposes, the investment thresholds for unlisted companies will be changed so that ESS participants can invest up to $30,000 per participant per year (accruable for unexercised options for up to 5 years), plus 70% of dividends and cash bonuses. Participants will also be able to invest any amount if it would allow them to immediately take advantage of a planned sale or listing of the company.

- Carbon credit and biodiversity certificate income – the proceeds from the sale of Australian Carbon Credit Units (ACCUs) and biodiversity certificates generated from on-farm activities will be treated as primary production income for the purposes of the Farm Management Deposits (FMD) scheme and the tax averaging provisions from 1 July 2022.

- Digitalising trust income – all trust tax return filers will be given the option to lodge income tax returns electronically, increasing pre-filling and automating ATO assurance processes. The measure is proposed to apply from 1 July 2024 (subject to advice from software providers).

- PAYG instalments option – from 1 January 2024, companies will be allowed to choose to have their PAYG instalments calculated based on current financial performance, extracted from business accounting software (with some tax adjustments).

- Taxable payments data reporting – from 1 January 2024, businesses will be provided with the option to report Taxable Payments Reporting System data on the same lodgment cycle as their activity statements, via accounting software.

Superannuation

The superannuation measures include:

- Super pension drawdowns – 50% reduction extended to 2022-23 – the temporary 50% reduction in minimum annual payment amounts for superannuation pensions and annuities will be extended by a further year to the 2022-23 income year.

- Super Guarantee rate – the Budget did not contain any change to the legislated Super Guarantee rate rise from 10% to 10.5% for 2022-23.

Other measures

- Fuel excise temporary reduction – the fuel excise will be reduced by 50% for 6 months, starting from midnight on Budget night.

- $250 cost of living payment – the Government will make a $250 one-off cost of living payment in April 2022 to eligible pensioners, welfare recipients, veterans and concession card holders.

- Apprentice wage subsidy extension – the Budget confirmed the extension of the Boosting Apprenticeship Commencement (BAC) and Completing Apprenticeship Commencements (CAC) wage subsidies by 3 months to 30 June 2022.

IN DETAIL

Personal Taxation

Low income offset – LMITO increased by $420 for 2021-22 (but not extended to 2022-23)

The low and middle income tax offset (LMITO) will be increased by $420 for the 2021-22 income year so that eligible individuals who earn up to $125,000 will receive a maximum LMITO benefit up to $1,500 for 2021-22 (up from the current maximum of $1,080).

This one-off $420 cost of living tax offset will only apply to the 2021-22 income year.

The LMITO for 2021-22 will be paid from 1 July 2022 to more than 10 million individuals when they submit their tax returns for the 2021-22 income year.

Low and middle income tax offset for 2021-22 (only)

| Taxable income (TI) $ | LMITO 2021-22 (current) $ | LMITO 2021-22 (proposed) $ |

| 0 – 37,000 | 255 | 675 |

| 37,001 – 48,000 | 255 + ([TI – 37,000] x 7.5%) | 675 + ([TI – 37,000] x 7.5%) |

| 48,001 – 90,000 | 1,080 | 1,500 |

| 90,001 – 126,000 | 1,080 – ([TI – 90,000] x 3%) | 1,500 – ([TI – 90,000] x 3%) |

| 126,001 + | Nil | Nil |

Low income tax offset (unchanged)

The low income tax offset (LITO) will also continue to apply for the 2021-22 and 2022-23 income years. The LITO was intended to replace the former low income and low and middle income tax offsets from 2022-23, but the new LITO was brought forward in the 2020 Budget to apply from the 2020-21 income year.

Low income tax offset for 2021-22 and 2022-23 (unchanged)

| Taxable income (TI) $ | Amount of offset $ |

| 0 – 37,500 | 700 |

| 37,501 – 45,000 | 700 – ([TI – $37,500] x 5%) |

| 45,001 – 66,667 | 325 – ([TI – $45,000] x 1.5%) |

| 90,001 – 126,000 | 1,080 – ([TI – 90,000] x 3%) |

| 66,668 + | Nil |

Personal tax rates unchanged for 2022-23; Stage 3 start from 2024-25 unchanged

In the Budget, the Government did not announce any personal tax rates changes. The Stage 3 tax changes commence from 1 July 2024, as previously legislated.

COVID-19 test expenses to be deductible

The Budget papers confirm that the costs of taking a COVID-19 test to attend a place of work are tax deductible for individuals from 1 July 2021. In making these costs tax deductible, the Government will also ensure FBT will not be incurred by businesses where COVID-19 tests are provided to employees for this purpose.

BUSINESS TAXATION

Deduction boosts for small business: skills and training and digital adoption

The Government announced two support measures for small businesses (aggregated annual turnover less than $50 million) in the form of a 20% uplift of the amount deductible for expenditure incurred on external training courses and digital technology.

External training courses

An eligible business will be able to deduct an additional 20% of expenditure incurred on external training courses provided to its employees. The training course must be provided to employees in Australia or online, and delivered by entities registered in Australia.

Some exclusions will apply, such as for in-house or on-the-job training.

The boost will apply to eligible expenditure incurred from 7:30pm (AEDT) on 29 March 2022 until 30 June 2024.

The boost for eligible expenditure incurred by 30 June 2022 will be claimed in tax returns for the following income year. The boost for eligible expenditure incurred between 1 July 2022 and 30 June 2024, will be included in the income year in which the expenditure is incurred.

Digital adoption

An eligible business will be able to deduct an additional 20% of the cost incurred on business expenses and depreciating assets that support its digital adoption, such as portable payment devices, cyber security systems or subscriptions to cloud-based services.

An annual cap will apply in each qualifying income year so that expenditure up to $100,000 will be eligible for the boost.

The boost will apply to eligible expenditure incurred from 7:30pm (AEDT) on 29 March 2022 until 30 June 2023.

The boost for eligible expenditure incurred by 30 June 2022 will be claimed in tax returns for the following income year. The boost for eligible expenditure incurred between 1 July 2022 and 30 June 2023 will be included in the income year in which the expenditure is incurred.

Scope of concessional tax treatment of patent box income extended

In the 2021-22 Budget, the Government announced the introduction of concessional tax treatment for eligible corporate income associated with new patents in the medical and biotechnology sectors (referred to “patent box” income).

Under legislation currently before Parliament (Treasury Laws Amendment (Tax Concession for Australian Medical Innovations) Bill 2022), such income will be taxed at a concessional rate of 17%, with effect for income years starting on or after 1 July 2022. Eligible income will be taxed at the concessional tax rate to the extent that the R&D of the innovation took place in Australia.

The Government will now extend the patent box income measures to provide concessional tax treatment for corporate taxpayers who:

- commercialise their eligible patents linked to agricultural and veterinary chemical products listed on the Australian Pesticides and Veterinary Medicines Authority’s Public Chemicals Registration Information System register, or eligible Plant Breeder’s Rights; or

- commercialise their patented technologies which have the potential to lower emissions. Patents relating to low emissions technology, as set out in the 140 technology areas listed in the Government’s 2020 Technology and Investment Roadmap Discussion Paper or included as priority technologies in the Government’s 2021 and future annual Low Emissions Technology Statements will be within scope, provided the patented technology is considered to reduce emissions.

In both cases, patent box income will be taxed at an effective income tax rate of 17% in relation to rights and patents granted or issued after 29 March 2022 and for income years starting on or after 1 July 2023.

The Government will consult with industry before settling the detailed design of the patent box extension.

PAYG instalments: option to base on financial performance

Companies will be allowed to choose to have their PAYG instalments calculated based on current financial performance, extracted from business accounting software (with some tax adjustments).

Date of effect – The commencement date will be subject to advice from software providers on their capacity to deliver. It is anticipated that systems will be in place by 31 December 2023, with the measure to commence on 1 January 2024.

PAYG and GST instalment uplift factor: 2% for 2022-23

The Budget papers confirm the Treasurer’s earlier announcement that the GDP uplift factor for PAYG and GST instalments will be set at 2% for the 2022-23 income year. The papers state that this uplift factor is lower than the 10% that would have applied under the statutory formula.

Date of effect – The 2% GDP uplift rate will apply to instalments that relate to the 2022-23 income year and fall due after the enabling legislation receives assent.

Employee share schemes for unlisted companies: thresholds amended

The Budget confirms the Government’s intention to change the investment thresholds for unlisted companies in relation to employee share schemes.

Where employers make larger offers in connection with employee share schemes in unlisted companies, participants can invest up to:

- $30,000 per participant per year, accruable for unexercised options for up to 5 years, plus 70% of dividends and cash bonuses; or

- any amount, if it would allow them to immediately take advantage of a planned sale or listing of the company to sell their purchased interests at a profit.

The Government will also remove regulatory requirements for offers to independent contractors, where they do not have to pay for interests.

Date of effect – not specified.

Concessional tax treatment of carbon credit and biodiversity certificate income

The Government will allow the proceeds from the sale of Australian Carbon Credit Units (ACCUs) and biodiversity certificates generated from on-farm activities to be treated as primary production income for the purposes of the Farm Management Deposits (FMD) scheme and the tax averaging provisions from 1 July 2022.

The Government will also change the taxing point of ACCUs for eligible primary producers to the year when they are sold, and extend similar treatment to biodiversity certificates issued under the Agriculture Biodiversity Stewardship Market scheme, from 1 July 2022.

Future Fund subsidiaries to be tax exempt

Wholly owned Australian incorporated subsidiaries of the Future Fund Board of Guardians (ie the “Future Fund Board”) will be exempt from corporate income tax. Currently, the Future Fund Board is exempt from income taxes, but this exemption does not extend to its wholly owned subsidiaries.

Extending this exemption will remove the administrative burden associated with the payment of tax by the subsidiaries and subsequent claiming of a refund.

Date of effect – The measure will commence from the first income year after the amending legislation receives assent.

TAX COMPLIANCE AND INTEGRITY

ATO’s Tax Avoidance Taskforce: extended operation, more funding

The Government will provide $325.0 million in 2023-24 and $327.6 million in 2024-25 to the ATO to extend the operation of the Tax Avoidance Taskforce by 2 years to 30 June 2025.

The Taskforce was established in 2016 to undertake compliance activities targeting multinationals, large public and private groups, trusts and high wealth individuals. It also scrutinises specialist tax advisors and intermediaries that promote tax avoidance schemes and strategies.

Taxable payments data reporting: option to link to BAS cycle

Businesses will be provided with the option to report Taxable Payments Reporting System data on the same lodgment cycle as their activity statements, via accounting software. The Government will consult with affected stakeholders, tax practitioners and digital service providers to finalise the policy scope, design and specifications of the measure.

Date of effect – Subject to advice from software providers about their capacity to deliver, it is anticipated that systems will be in place by 31 December 2023, with the measure to commence on 1 January 2024.

STP data to be shared with States and Territories

The Budget papers confirm the Government’s intention to develop the IT infrastructure required to allow the ATO to share single touch payroll (STP) data with State and Territory Revenue Offices on an ongoing basis.

SUPERANNUATION

Superannuation pension drawdowns – 50% reduction extended to 2022-23

The temporary 50% reduction in minimum annual payment amounts for superannuation pensions and annuities will be extended by a further year to 30 June 2023.

The 50% reduction in the minimum pension drawdowns, which has applied for the 2019-20, 2020-21 and 2021-22 income years, was due to end on 30 June 2022. However, the Government announced that the SIS Regulations will be amended to extend this temporary 50% reduction for minimum annual pension payments to the 2022-23 income year. Given ongoing volatility, the Government said the extension of this measure to 2022-23 will allow retirees to avoid selling assets in order to satisfy the minimum drawdown requirements.

Super Guarantee no change to legislated rate rise to 10.5% for 2022-23

The Budget did not announce any change to the timing of the next Super Guarantee (SG) rate increase. The SG rate is currently legislated to increase from 10% to 10.5% from 1 July 2022, and by 0.5% per year from 1 July 2023 until it reaches 12% from 1 July 2025.

With the SG rate set to increase to 10.5% for 2022-23 (up from 10%), employers need to be mindful that they cannot use an employee’s salary sacrificed contributions to reduce the employer’s extra 0.5% of super guarantee. The ordinary time earnings (OTE) base for super guarantee purposes now specifically includes any sacrificed OTE amounts.

SG opt-out for high-income earners

The increase in the SG rate to 10.5% from 1 July 2022 also means that the SG opt-out income threshold will decrease to $261,904 from 1 July 2022 (down from $275,000).

OTHER MEASURES

One-off $250 cost of living payment

The Government will make a $250 one-off cost of living payment in April 2022. The payment will only be available to Australian residents who are eligible recipients of the following payments and to concession card holders:

- Age Pension

- Disability Support Pension

- Parenting Payment

- Carer Payment

- Carer Allowance (if not in receipt of a primary income support payment)

- Jobseeker Payment

- Youth Allowance

- Austudy and Abstudy Living Allowance

- Double Orphan Pension

- Special Benefit

- Farm Household Allowance

- Pensioner Concession Card (PCC) holders

- Commonwealth Seniors Health Card holders

- eligible Veterans’ Affairs payment recipients and Veteran Gold card holders.

The $250 payment will be tax-exempt and not count as income support for the purposes of any Government income support. A person can only receive one economic support payment, even if they are eligible under 2 or more of the categories outlined above.

Temporary reduction in fuel excise

The Government will reduce the excise and excise-equivalent customs duty rate that applies to petrol and diesel for 6 months by 50%. The excise and excise-equivalent customs duty rates for all other fuel and petroleum-based products, except aviation fuels, will also be reduced by 50% for 6 months.

The Treasurer said this measure will see excise on petrol and diesel cut from 44.2 cents per litre to 22.1 cents. The Treasurer made a point of emphasising that the ACCC will monitor the price behaviour of retailers to ensure that the lower excise rate is fully passed on.

Date of effect – The measure will commence from 12.01am on 30 March 2022 and will remain in place for 6 months, ending at 11.59pm on 28 September 2022.

Streamlining the administration of fuel and excise requirements

The Government intends to streamline the administration of fuel and alcohol excise and excise-equivalent customs goods. From 1 July 2023, the changes will:

- enable fuel and alcohol businesses with an annual turnover of less than $50 million to lodge and pay excise and excise-equivalent customs duty on a quarterly basis, rather than weekly or monthly as at present. These businesses will lodge returns and pay excise by the 28th day of the month after the end of each quarter;

- streamline and align licensing requirements across the excise system, by removing all renewal requirements for excise and excise-equivalent customs goods licences and removing licence fees;

- amend the excise and excise-equivalent customs duty regime for fuel by introducing a refund provision, similar to that in the excise law, for excise-equivalent customs duty on petroleum-based oils used in the further manufacture of petroleum lubricants, ending double taxation of these oils;

- amend the excise law to provide a targeted exemption from excise licensing requirements, up to a threshold of 10,000 litres per year, for licensed hospitality venues to fill beer from kegs into sealed, non-pressurised containers of no more than 2 litres capacity and not designed for medium- to long-term storage.

Apprentice wage subsidy support extension

The Budget confirms the Government’s earlier announcement to extend the Boosting Apprenticeship Commencement (BAC) and Completing Apprenticeship Commencements (CAC) wage subsidies by 3 months to 30 June 2022.

First Home Guarantee Scheme: additional places announced

The Government has announced that it will expand the Home Guarantee Scheme in the 2022-23 Budget to make available up to 50,000 places each year, including 10,000 places for a new Regional Home Guarantee open to non-first home buyers.

Under the expanded Scheme, the Government said it will make available:

- 35,000 guarantees each year (up from the current 10,000), from 1 July 2022 under the First Home Guarantee, to support eligible first homebuyers to purchase a new or existing home with a deposit as low as 5%;

- 10,000 guarantees each year (from 1 October 2022 to 30 June 2025), under a new Regional Home Guarantee, to support eligible homebuyers (including non-first home buyers and permanent residents, to purchase or construct a new home in regional areas), subject to the passage of enabling legislation; and

- 5,000 guarantees each year (from 1 July 2022 to 30 June 2025) to expand the Family Home Guarantee to help eligible single parents with children to buy their first home or to re-enter the housing market with a deposit of as little as 2%.

Under the existing Scheme, eligible first home buyers can obtain a loan to build a new home or purchase a newly built home with a deposit of as little as 5%.

Outstanding Bills before both Houses

When Parliament resumed on 29 March, there were several Bills (tax, super and other measures – some more important than others) before both Houses. It is possible that some of these Bills will lapse when the Prime Minister calls a Federal election.

Where to from here?

If you would like assistance understanding how announcements in this budget impact you please contact your AFS accountant or our office on 03 5443 0344.

The 2022-23 Budget Papers are available from the following website: